Advisor Perspective

Advisor Perspective

Understanding IRMAA – Medicare’s Income-Related Monthly Adjustment Amount

For high income Medicare beneficiaries, there is a stealth tax that can increase the premiums you pay for Medicare. The Income Related Monthly Adjustment Amount (IRMAA) for Medicare Part B (hospital stays) went into effect in 2007, and for Part D (prescription drugs) in 2011. Part B and Part D premiums include an additional surcharge based on your income level.

Eligibility

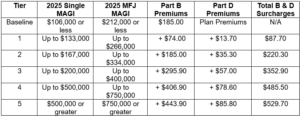

For 2025, Medicare beneficiaries with income over $106,000 (for single tax filers and for married people who file separately) or $212,000 (for Married Filing Jointly (MFJ) filers) will pay the surcharge. The total monthly surcharge for these beneficiaries will range from $87.70 to $529.70 (see chart below).

IRMAA 2025: Part B and Part D Monthly Premiums

How IRMAA is Calculated

The Social Security Administration (SSA) uses your Modified Adjusted Gross Income (MAGI) to determine if you owe more than the base premium. MAGI for purposes of determining your Medicare premium adjustment is a two-year lookback. For example, to calculate for 2025, the SSA examined the 2023 tax returns to determine your MAGI. If your income is over the threshold, you will owe extra payments.

To calculate your MAGI, start with your Adjusted Gross Income (AGI). The most common sources of AGI for most retirees are wages, IRA withdrawals (including Roth conversions), interest income, capital gains, dividends, pension income, rental income, and only the taxable portion of your Social Security benefits. To arrive at MAGI, you add non-taxable interest (i.e. municipal bond interest) to your AGI.

Just as important is to understand what types of income do not contribute to IRMAA. Roth IRA and Roth 401(k) withdrawals do not count, regardless of the withdrawal amount. Qualifying withdrawals from Health Savings Accounts also does not count towards IRMAA.

Strategies to Manage IRMAA

Lowering your income is the best way to avoid or reduce IRMAA surcharges. The following strategies are worth exploring to help reduce your income and potentially escape the Medicare surcharge while in retirement.

- Roth Conversions: Roth conversions can help reduce the impact of IRMAA on your Medicare premiums. By reducing the balance in your traditional IRAs and 401(k)s, you are reducing future Required Minimum Distributions (RMDs). This reduces income, thereby minimizing the potential impact of IRMAA. Before RMDs start, you have the ability to control the timing and the amount of the withdrawals, instead of the government.

- Making Qualified Charitable Distributions: A Qualified Charitable Distribution (QCD) is a direct donation from your traditional IRA to a qualified non-profit organization. If you are 70 ½ or older, you can make a QCD of up to $108,000 per year in 2025. QCDs are not included in AGI and can be used to satisfy some or all of your RMDs.

- Donating Appreciated Assets: If you have appreciated investments like mutual funds, ETFs, or stocks, you can donate those assets directly to charity. Donating appreciated assets can help reduce future investment income and capital gains.

- Reducing Taxable Income Through Asset Location: Focusing on holding assets that generate ordinary income in tax-advantaged accounts can reduce AGI (See prior JMG article: Asset Location: Maximizing the After-Tax Return of Your Portfolio)

What if Your Income Decreases?

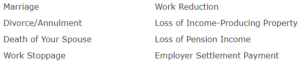

If your income is lower today than when you exceeded the baseline MAGI, you may be able to reduce the surcharge based on life-changing events.

The Social Security Department defines life-changing events as any of the following:

To request an IRMAA reduction, you can submit Form SSA-44 to the Social Security Administration or call 800-772-1213.

Final Thoughts

A considerable number of Medicare beneficiaries do not learn about IRMAA until they are blindsided by this stealth tax. However, proper planning can help mitigate the impact of IRMAA. Feel free to contact your JMG advisor if you have questions about how IRMAA could impact you. We invite you to share this article with others who may also find it insightful.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.