Thoughts on Ukraine

INVESTMENT COMMITTEE COMMENTARY February 2021

There is no downplaying the human suffering caused by Russia’s invasion of Ukraine. Our thoughts and prayers are with the people of Ukraine and those with family and friends that may be in harm’s way. The outcome remains uncertain. That said, we will attempt to address the implications from an investment perspective.

Inflation continues to be the biggest risk to the U.S. economy. The most recent headline consumer price index (CPI) inflation rate is 7.5%. Of note, the producer price index (PPI) which tracks mostly the cost of goods to producers is 9.8%. Based on underlying data, upward inflation pressure will likely persist for the near term. The Federal Reserve is in a difficult position managing interest rates and inflation without stifling U.S. economic growth. Global supply chains continue to be disrupted even as COVID-19 restrictions are easing. Oil prices continue to spike higher. The length of the market sell-off is uncertain, largely depending on whether global economic growth can continue and whether there is escalation in the Ukrainian conflict.

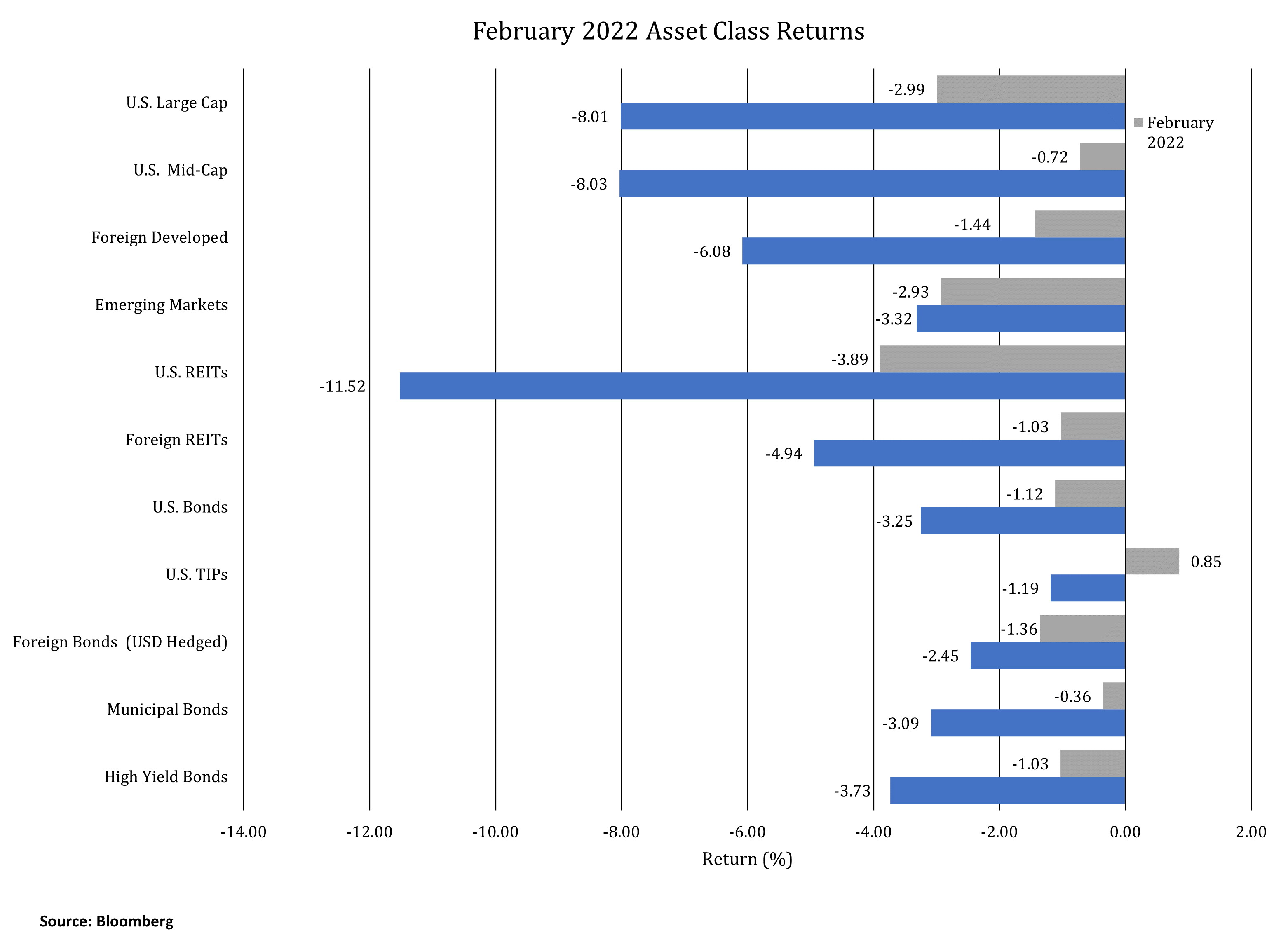

For February, all broad equity asset classes declined. The S&P 500 fell 3.0%. Mid-cap stocks performed relatively better, down only 0.7%. The foreign developed and emerging markets equities had better performance relative to U.S. equities.

Fixed income performance in February was weak due to increasing interest rates and inflation. The yield on 10-year U.S. Treasuries rose slightly from 1.78% to 1.84%. Of note, the benchmark yield reached over 2.00% as late as February 17th before falling as Russia moved into Ukraine. Treasury Inflation Protected Securities (TIPS) had positive February performance of 0.85%.

Thoughts on Ukraine

Sanctions against Russia have been imposed by the United States and other countries. U.S. sanctions include measures against Russia’s central bank to freeze accounts, which hinders their access to financial assets. Some Russian banks have been barred from the SWIFT international payments system which is designed to disrupt trade between Russia and the rest of the world. Other countries have applied sanctions including export controls and directly targeting Vladimir Putin and his close associates (oligarchs).

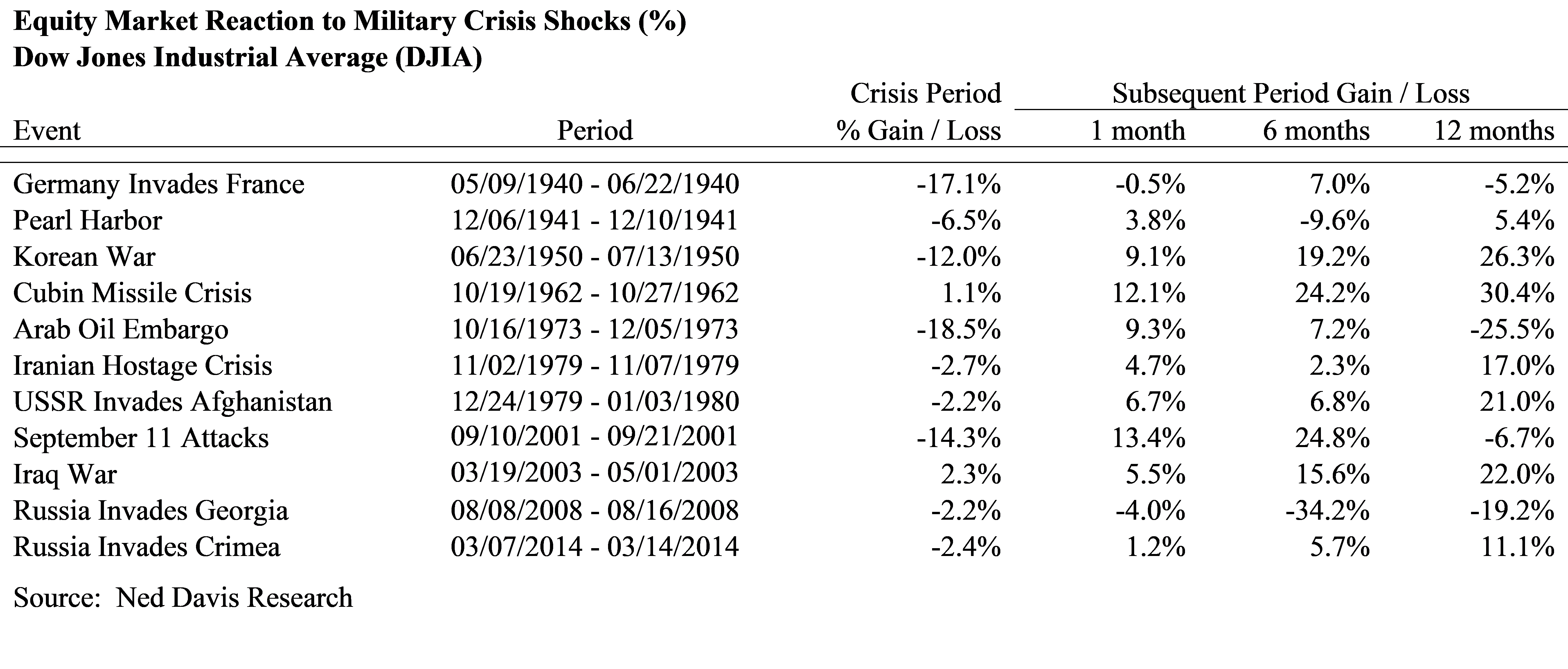

Predictably, financial markets have reacted with volatility and stock prices have fallen. Historically, military and terrorist crises have short-term impacts on financial markets. The below chart is a selection of crisis events and the performance of the Dow Jones Industrial Average during each crisis and in the following year. Investment performance tends to improve in subsequent periods, noting that markets are typically reacting to multiple events at the same time. For example, market performance following the Russian invasion of Georgia in 2008 was more impacted by the impending financial crisis in the U.S. rather than the geopolitical events in Georgia.

Investors should expect continued market volatility until the outcome of the Russian invasion is determined.

- We do not recommend timing investment moves during these periods. We have long maintained a disciplined investment approach so that equity assets do not need to be sold in such market declines.

- JMG client portfolios have minimal direct or indirect exposure to Russia. Emerging market indexes have less than a 3% allocation to Russian based companies. JMG does not recommend emerging market bonds and foreign developed market bonds are currency hedged so there is no direct exposure to Russian bonds or the ruble.

- The Ukrainian crisis will likely cause greater or extended global supply chain disruptions.

- As a result of Russia’s actions, it is now likely the Federal Reserve will move slower with rate hikes. With recent U.S. inflation, some were expecting the Fed to raise interest rates by 0.50% in March. Currently, a hike of 0.25% is more likely. Currently, the markets are expecting five Fed rate hikes in 2022.

- The crisis seems to have created a more unified Europe and should favor global economic growth along with diversification away from reliance on Russian oil exports. Europe imports approximately 25% of its crude oil and 40% of its natural gas from Russia, which is significant, but it can be replaced from other sources. Europe can be expected to rethink its energy policy and fossil fuel producers may benefit.

- The greatest risk to the U.S. economy remains inflation and a potential recession which can be fueled by the Fed tightening too much. Recession is not our base case, but Fed policy is critical. Normalization of trade and supply chains is also important as the world emerges from COVID-19 lockdowns. Regarding fiscal policy, the U.S government will need to slow spending and work with the Fed to manage the inflation spike.

- Action steps that may be appropriate include portfolio rebalancing, Roth IRA conversions, tax loss harvesting, and the acceleration of dollar cost averaging strategies. Further, a review of estate and gift planning strategies may be appropriate to benefit from future appreciation of assets outside a donor’s estate.

Please contact your JMG advisor with questions or concerns.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg US Aggregate Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bonds (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).