Monthly Economic News

Monthly Economic News

Thoughts on Inflation

INVESTMENT COMMITTEE COMMENTARY MAY 2021

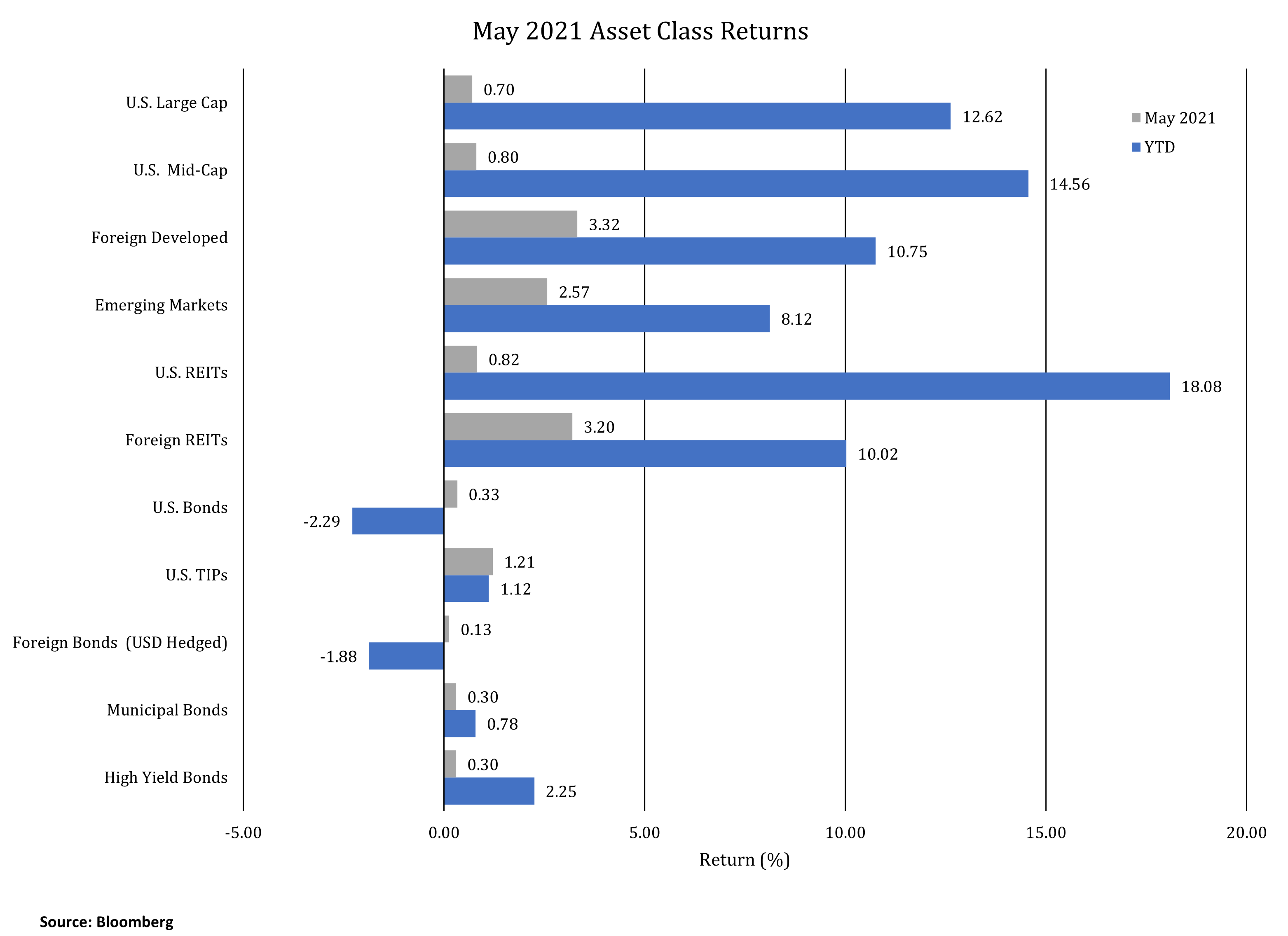

While increasing inflation concerns persist, improving global economic data fueled positive equity returns in May. Foreign developed markets were up 3.3% and outperformed their U.S. and emerging markets counterparts. Stronger economic and corporate earnings growth was already priced in U.S. equities, ahead of foreign stocks. The European economic turnaround is finally occuring with the easing of lockdowns, stimulative bond purchases by the European Central Bank, and accelerating vaccinations. European GDP is expected to move positive in the second quarter as market valuations have been lower than in the U.S.

Over the long-run, the stock market is driven by earnings growth. Corporate earnings are accelerating. Ned Davis Research reports 87% of S&P 500 companies are beating analyst consensus estimates. Earnings have not only been bolstered by the speed at which economies are reopening, but also by disposable personal income that has exploded through central bank accommodation and direct stimulus payments. However, for the market rally to continue, the private sector will ultimately need to be the significant driver of earnings. Government stimulus, when withdrawn, poses a risk to earnings and to the equity markets.

The yield on 10-year U.S. Treasuries fell for the second straight month, closing at 1.60%. Therefore, bonds had modest positive performance in May. An increase in bond yields may have a higher probability as the Federal Reserve has signaled it will allow the economy to run “hot” with an inflation target of 2.0-2.5%.

Thoughts on Inflation

JMG advisors have received many questions from clients on the topic of inflation. Most economists believe the consumer price index (CPI) will increase over the next several years. We would agree that inflation is likely to rise over time but we also think that the media’s reporting on headline CPI is a bit misleading. Headline CPI alone provides limited analysis of the components making up the index and why prices are changing. CPI historically goes up following recessions, as observed following the 2002 and 2008 recessions. The National Bureau of Economic Research has not yet called the end of the COVID-19 recession, but the trough may very well be dated in 2020. If so, the recent price increases would be consistent with those following the 2002 and 2008 recessions and could be characterized as a rebound from recession and not an inflation outbreak.

Charles Schwab & Co. comments that the Federal Reserve’s current position that any inflation will more likely be transitory, requiring no change to its monetary stance. Sustained inflationary pressures have historically come from a severe tightening in the labor market, which significantly pushes up wages generating the type of “wage-price spiral” inflation that became systemic in the 1970s. Currently, this is not the case.

By definition, inflation is a widespread and persistent rise in prices over time. At this point, we cannot conclude on either widespread or persistent price conditions. The most recent year over year headline CPI in April was 4.2%. Included in the headline index was gasoline CPI at 49.6% and used car and truck CPI at 21.0%. Regarding gasoline, in April 2020, crude oil futures traded at a negative $40 / bbl. Today, the price is positive $60 / bbl. The year over year price change is dramatic, but the current price is at a more normal level. Used car and truck prices are higher because dealers were doing whatever they could to survive the pandemic as consumer demand plummeted. Supply chains need time to stabilize. What we have seen is a strong rebound in demand as economies open while, understandably, supply is lagging The movement of goods continues to be disrupted as workers and productive resources, especially in logistics, need time to come back into sync. Therefore, price pressures in the short run definitely exist, but may be transitory.

JMG strategically recommends allocations to asset classes that historically have contributed positively to portfolio returns during inflationary times. These include real estate (REITs), treasury inflation protected securities (TIPs), and emerging market equities. Foreign currencies, which are a performance component of international equity investments, also provide positive returns to U.S. investors when the U.S. dollar is falling in value.

We continue to closely monitor inflation data and potential effects on client portfolios. If you have any questions, you should consult with your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg Barclays Capital U.S. Aggregate Index); U.S. TIPs (Bloomberg Barclays Capital U.S. Treasury: U.S. TIPs); Foreign Bonds (USD Hedged) (Bloomberg Barclays Capital Global Aggregate Ex U.S. TR Hedged); Municipal Bonds (Bloomberg Barclays Capital Municipal Bond Index); High Yield Bonds (Bloomberg Barclays Capital High Yield Index).