U.S. Debt Ceiling

INVESTMENT COMMITTEE COMMENTARY April 2023

Investors weighed three key issues in April: The Federal Reserve’s (Fed’s) next interest rate move, corporate earnings, and the financial strength of U.S. regional banks. The Fed did not meet in April but did raise interest rates by 25 basis points on May 3rd. The Fed hinted at a pause of further rate increases and will monitor future progress in reducing inflation. The consumer price index (CPI) has fallen to 5.0% which is down 3.9% from its 2022 high. However, 78% of the CPI decrease is due solely to gasoline prices. Important CPI components including rent of primary residence, owner’s equivalent rent and food all have current inflation levels above 8.0%.

Solid corporate earnings have helped stock momentum. While quarterly earnings are declining moderately, the actual results are better than expected. As of the end of April, 79% of S&P 500 companies reported earnings ahead of consensus estimates, the best “beat” results since the fourth quarter of 2021. Earnings have been positive for investor sentiment.

The markets in general have taken the failures of Silicon Valley Bank, Signature Bank and First Republic Bank in stride. Many bank customers are considering whether to shift some of their bank deposits to money market funds. Further bank deposit withdrawals would continue to stress bank financial conditions in the short run. Any new government regulation of regional banks to ratchet up capital and increase liquidity requirements will impact the banks.

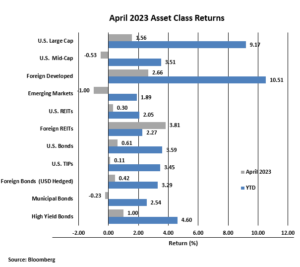

Most asset classes had positive returns in April. The S&P 500 gained 1.6% and foreign developed equities rose 2.7%, while emerging markets fell 1.0%. Mid-cap stocks and REITs, which have higher sensitivity to rising interest rates and reliance on bank lending than their large cap brethren, had weak April performance. However, foreign REIT performance rebounded for the month, up 3.8%.

In the fixed income asset class, falling bond yields contributed to positive performance. The yield on 10-year Treasuries fell slightly from 3.49% to 3.44%. As a result, the Bloomberg U.S. Aggregate Bond Index rose 0.6% in April. Bond performance is consistent with expectations given the changes in interest rates. The markets are expecting interest rate cuts sooner than the Fed has indicated.

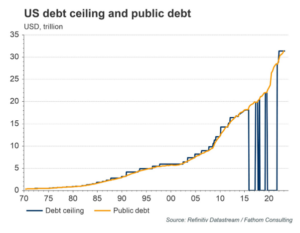

U.S. Debt Ceiling

The ceiling on U.S. debt will be prominent in the news this month. The debt ceiling is $31.4 trillion, and the current U.S. debt is very close to the limit. As a result, the U.S. Treasury is deploying extraordinary measures to remain below this level until Congress acts to raise the debt ceiling.

In 1917, during World War I, the debt ceiling was created by Congress. Before that, Congress itself approved all debt issues through Acts of Congress. Since 1917, the national debt has been increased under every presidential administration. It was raised over 90 times in the 20th century. It was raised 74 times between 1962 and 2011. It was raised 14 times from 2001 to 2016. Congress has suspended the debt ceiling 7 times since 2013 including the COVID years through July 31, 2021. Therefore, the U.S. debt ceiling is not a new issue.

If the government hits the debt ceiling, the Treasury Department is barred from issuing treasury bonds and borrowing more money. The result would be the United States could not pay all its outstanding obligations in a timely manner, negatively impacting the global economy. Once the debt ceiling is raised by Congress, the government can issue debt and pay its ongoing bills.

The act of raising the debt ceiling typically leads to a political showdown between Democrats and Republicans in a recurring drama of contentious debate and rhetoric ultimately resulting in an 11th hour resolution to avoid default. Because everyone knows it is in no one’s interest to allow a U.S. default, it is expected politicians will act just before the point of no return when the Treasury Department has exhausted all extraordinary measures. A U.S. default would likely have dramatic negative effects including recession, unstable and possibly surging yields of U.S. Treasuries, and a sharply falling stock market. We do not expect default will occur because the economic consequences would be so negative for all parties. However, it cannot be dismissed.

Uncertainty over the debt ceiling will likely lead to increased market volatility. The timing and magnitude of a U.S. recession could be made worse by an extended debt ceiling stand-off. In this environment, we are currently recommending clients maintain strategic weightings in their portfolios with appropriate cash cushions. Timing such events is impossible and we have noted in prior Market Observations the detrimental effects of missing strong market days which often occur in volatile periods.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).