The Recession Debate and Some Rays of Hope

INVESTMENT COMMITTEE COMMENTARY July 2022

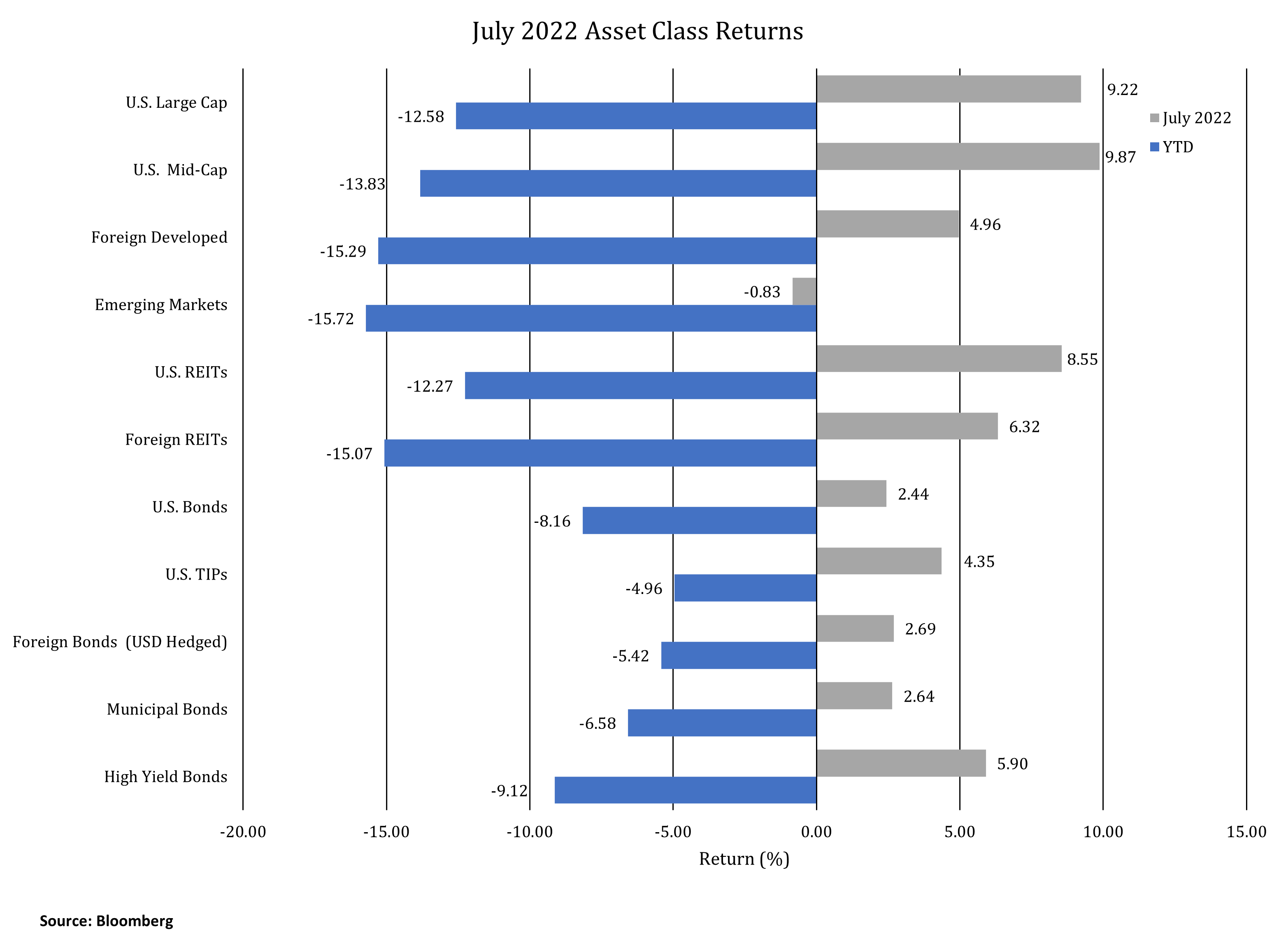

A welcome relief rally brought positive performance to most equity and fixed income asset classes in July.

The S&P 500 and foreign developed equities gained 9.2% and 5.0%, respectively. Emerging market (EM) equities declined 0.8% with lingering issues in China, a rising U.S. dollar and falling capital inflows to EM markets. For the month, the yield on 10-year Treasuries fell from 2.97% to 2.64%. Intermediate investment grade bonds gained 2.44% in July on the decline in interest rates.

While investment performance was positive in July, some economic data remained concerning. The consumer price index (CPI) rose to 9.1%, its highest level since 1981. With another high inflation reading, the Federal Reserve (Fed) further increased interest rates by 0.75%. Gross domestic product (GDP) fell by 0.9% in the second quarter. Over the past year, the steady rise in inflation has claimed a larger and larger share of the nominal growth. As a result, real GDP growth has been negative for the last two quarters. Broadly, the headwinds of inflation and tighter monetary policy by the Fed are slowing economic growth creating a tenuous balance between inflation and recession.

Why did stocks and bonds rise in July? One reason was a changing investor sentiment in reaction to Federal Reserve Chairman Jerome Powell’s remarks on July 27th. While Chairman Powell stated that the Fed was committed to reducing the high level of inflation, he also noted signs of economic slowing such as in consumer spending and industrial production. Furthermore, Mr. Powell refrained from giving guidance about future Fed rate hikes. Investors interpreted his remarks to mean the economy is slowing more quickly than anticipated and the Fed would be less aggressive, ending the rate hikes sooner. Investors began sensing a more moderate Fed and a recession of shorter duration. Therefore, sentiment improved even with lingering economic uncertainties.

The Recession Debate and Some Rays of Hope

It is not useful to debate about the technical definition of a recession. Chairman Powell stated, “recent indicators of spending and production have softened”. Translation: U.S. economic growth is slowing. The issue is not whether there will be a recession but how deep, long, and widespread a slowdown may be.

Rays of hope come from a few July positives:

- Commodities, particularly crude oil, have recently fallen in price. Crude oil has fallen from a 2022 high price of $130.50/bbl on March 7th to $97.83/bbl on July 31st. Recently, there has been a drop in U.S. regular unleaded gas prices from $4.62/gallon on July 4th to $4.03/gallon on August 1st. Other commodities that serve as inputs to consumer and industrial goods have also fallen. The moderating commodity prices are not yet reflected in official CPI numbers, but are providing some optimism that inflation is peaking.

- The Fed has raised short-term interest rates by 0.75% in each of the last two months. Fed tightening is one tool used to moderate money supply growth which fuels inflation. The Fed is attempting to tame inflation by these actions and may have success in bringing inflation under control.

- Should a recession occur, the slowdown could be moderate in severity. Tony Crescenzi, PIMCO Strategist and Portfolio Manager, notes relatively strong initial conditions in housing, household balance sheets, excess labor demand, healthy banks, and investment imperatives for productivity enhancing energy and technology needs can diminish the depth and duration of recession.

- Not everyone is impacted equally by headline CPI. For example, while housing components of CPI have been rising, many homeowners and businesses have locked in low interest, fixed rate mortgages and loans so they are less impacted by the high headline CPI level. Unfortunately, lower and middle income people who spend higher percentages of their income on necessities such as food at home and gasoline to get to work may be more negatively affected by inflation. Hopefully, the progress of supply chain normalization can ease the burden on those most affected.

- The U.S. unemployment rate remains at 3.6% (a 50-year low) with a new reading out shortly. Private nonfarm payroll employment continues to expand at a year over year rate of 4.9%.

Investor sentiment turned more positive in July. With the drop in interest rates, investors seem to be expecting the Fed to reverse course in early 2023. This new optimism is based on the expectation the recession will be shorter and less severe.

If you have any questions, you should consult with your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg US Aggregate Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bonds (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).