Monthly Economic News

Monthly Economic News

The American Jobs Plan

INVESTMENT COMMITTEE COMMENTARY APRIL 2021

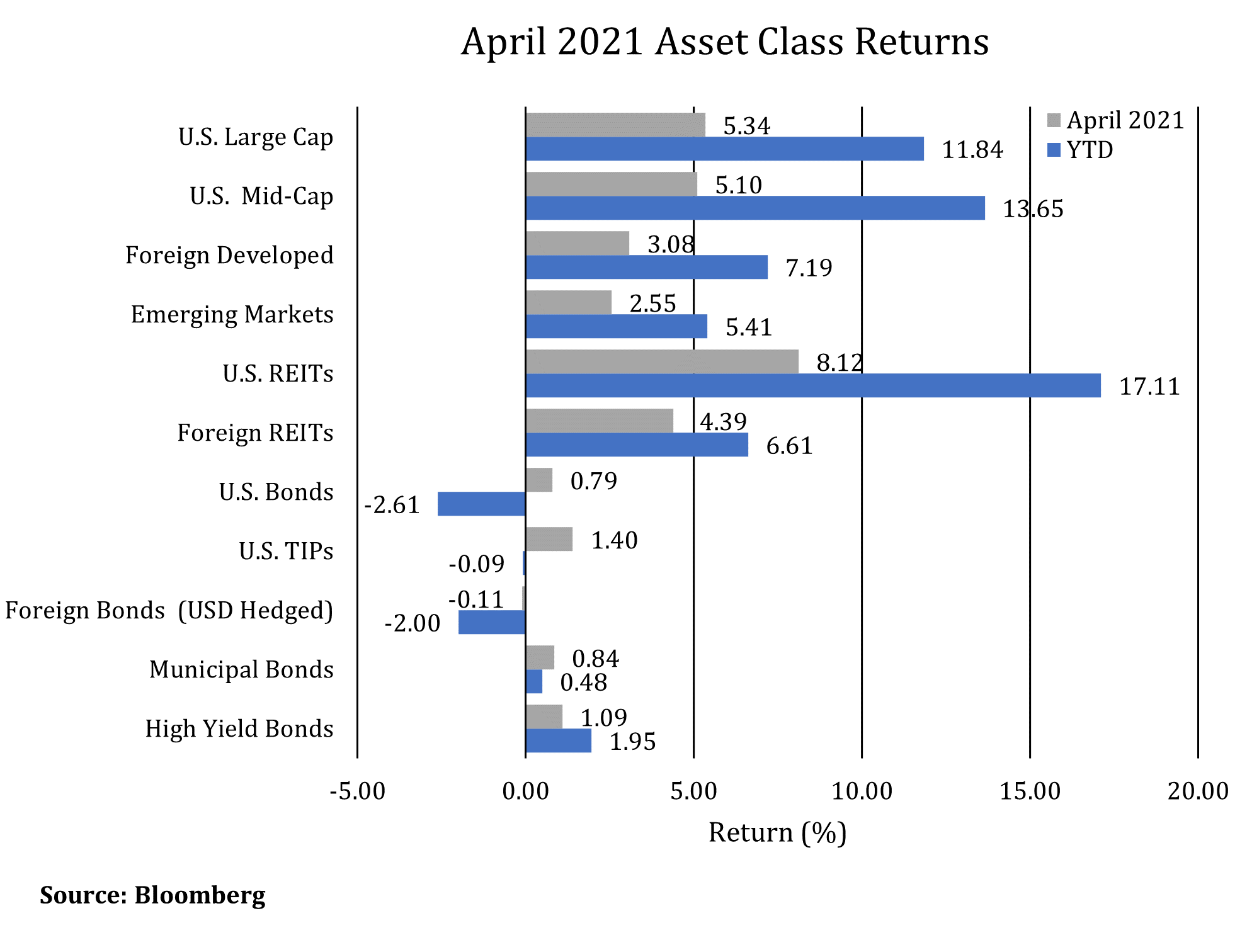

Investment performance was positive in April as the U.S. economy continued to rebound. Central bank accommodation, consumer confidence and decreasing weekly jobless claims supported equity markets. Major stock indexes reached all-time highs during the month and closed April near those highs. Corporate earnings are one factor fueling the strong markets. S&P 500 operating earnings per share (EPS) declined during the pandemic from $157.12 to $122.37. In 2021, earnings are expected to grow significantly. S&P Dow Jones expects trailing 12-month earnings of $148.66 in March with $183.52 estimated by year end.

The yield on 10-year Treasuries fell from 1.74% to 1.65% during April. With generally falling yields, bonds had modest positive performance during the month. Bond yields are expected to remain low for now, but there is a risk of increased inflation.

Outlook for President Biden’s Tax Proposal

To pay for new and expanded government programs as outlined in President Biden’s address to a joint session of Congress on April 28, 2021, Biden proposed The American Jobs Plan. This plan includes some of the following provisions:

- An increase in the top income tax rate from the current 37.0% to a proposed 39.6% for joint filers with $628,300 of income, and for single filers with $523,600 of income. This a return to the top tax rate before the 2017 Tax Cuts and Jobs Act.

- For taxpayers with income over $1 million, the proposal would raise the top tax rate on capital gains and dividends from 23.8% to 43.4%. If passed, it would be the first time distributions from IRAs are taxed at a lower rate than capital gains and could impact asset location strategies for some clients.

- The carried interest ‘loopholes’ that potentially benefitted partners of private equity and hedge funds would be eliminated, resulting in this type of income being taxed at ordinary income tax rates.

- Biden indicated that filers making less than $400,000 annually would not pay any more in taxes and would continue to pay taxes at the current tax rates.

- Biden proposed additional governmental resources to be allocated to the IRS for an increase in IRS examinations and enforcement of taxpayers making more than $400,000 in income.

- The federal corporate tax rate would be raised from 21% to 28%, a 15% minimum tax on “book profits” would be established, and the minimum tax on select overseas profits would increase from 10.5% to 21%.

- Separately, under Biden’s American Families Plan, for estate tax purposes, step-up basis at death would be eliminated on gains of more than $2 million for joint filers, and $1 million for single filers. Biden also proposed to increase the 2021 estate tax rate of 40% for estates above the exemption amount. Notably, the current estate and gift tax exemption amount is not changed under the Biden proposal and would remain at the current level of $11.7 million per person, indexed to inflation.

The proposal highlights the need to plan carefully and run the math before making any snap decisions. The decision to sell now or hold appreciating assets at a greater tax cost depends on when someone needs the money. Also, tax rates may change again.

We want to emphasize this is only a proposal. Congress may not adopt the plan and changes are likely to be made. Therefore, JMG is not recommending any investment changes based solely on tax proposals. We will continue to monitor the actual provisions that may get implemented.

If you have any questions, please contact your JMG advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg Barclays Capital U.S. Aggregate Index); U.S. TIPs (Bloomberg Barclays Capital U.S. Treasury: U.S. TIPs); Foreign Bonds (USD Hedged) (Bloomberg Barclays Capital Global Aggregate Ex U.S. TR Hedged); Municipal Bonds (Bloomberg Barclays Capital Municipal Bond Index); High Yield Bonds (Bloomberg Barclays Capital High Yield Index).