Stablecoin Digital Currency Update

INVESTMENT COMMITTEE COMMENTARY July 2025

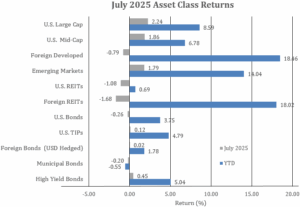

The economy remained resilient while some signs of weakening appeared in July economic data points. The stock market continued its upward trend from the second quarter, albeit with some volatility. Both the S&P 500 and the NASDAQ reached record highs in July, buoyed by strong corporate earnings and positive sentiment. For much of the month, large cap stocks generally outperformed smaller companies which often have greater interest rate sensitivity.

Bond prices in July were roughly flat. The yield on 10-year Treasuries rose from 4.24% to 4.37%. The Bloomberg U.S. Aggregate Bond Index fell by 0.3% for the month. The Federal Reserve left the fed funds rate unchanged in July.

![]()

July Economic Update

Inflation – Inflation remains “somewhat elevated.” Headline Consumer Price Index (CPI) is at 2.7% year over year, while core inflation (excluding food and energy) is at 2.9%. While inflation ticked up in June, the inflation rate has still declined for the year. However, inflation is not yet making strong and consistent progress toward the Federal Reserve’s (Fed) target inflation rate of 2.0%. This is one reason the Fed has continued to maintain tighter monetary policy.

GDP – The U.S. economy has remained resilient but is showing underlying signs of weakness. The gross domestic product (GDP) rose 3.0% in the second quarter following a 0.5% contraction in the first quarter. While GDP in the second quarter appears to be strong, it is skewed by the timing of tariffs and company reactions that have impacted the timing of their inventories, imports and fixed investments. Considering the volatility this year, it is best to focus on the YTD average GDP growth rate of approximately 1.25%. This is down from the 2024 full year rate of 2.8% and does not provide sufficient evidence of a U.S. rebound or renewed economic strength. Consumption, fixed investments, exports, and imports are weak, and volatility could persist until there is more definition on tariffs and the longer-term impacts on international trade.

Employment – For July, U.S. employment reports showed concerning and weak jobs data, with sizeable and negative revisions for the prior months of May and June. In July, nonfarm payroll increased by a lower than expected 73,000 jobs. The official unemployment rate tipped higher to 4.2%, even as the U.S. labor force fell for the third consecutive month. Of note, the Trump administration fired Erika McEntarfer, commissioner of the Bureau of Labor Statistics, in response to the unusually large negative revisions. In reviewing the underlying data, more than half of the revisions involve state and local government education sector jobs, which often decline in the summer months. Overall, the July jobs report was weak but really confirmed weaknesses that have had indications in prior months.

Summary – Big picture, the world continues to process the dramatic changes in economic policy which the Trump administration is implementing.

- So far, the US and global economies remain relatively resilient.

- Tariff negotiations continue with outcomes less extreme than many feared.

- Based on weakening GDP and jobs data, the Fed is more likely to cut rates sooner so long as secular inflation (inflation not due to tariffs) does not pick up.

- There are countervailing trends. Deregulation and onshoring of manufacturing may offset the impact of tariffs on the US economy.

- Winners and losers will continue to be dynamic and unpredictable. Therefore, diversification remains the strategy we recommend.

GENIUS Act – The U.S. Establishes a Regulatory Framework for Stablecoin Digital Currency

The GENIUS Act was signed into law by President Trump in July. GENIUS stands for Guiding and Establishing National Innovation for U.S. Stablecoins. This was important legislation in the world of cryptocurrency. The GENIUS Act creates the first federal regulatory framework for stablecoins.

What are Stablecoins and Why They Matter?

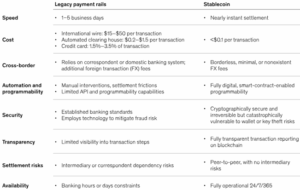

Cryptocurrency (crypto) is a digital asset that operates globally on a decentralized network called a blockchain. When most people think about cryptocurrency, they probably think about Bitcoin or Ethereum, which are types of Altcoins: digital currencies whose prices vary independently from traditional currencies. Bitcoin values can be very volatile with strong price movements higher or lower. Stablecoins are a subset of crypto designed to maintain a stable value by being pegged to a reserve asset (e.g., U.S. dollar, U.S. Treasury Bills, gold, etc.). The goal of stablecoins is to provide global, low cost, speedy, and secure transaction execution and payments with a price stable medium. The following chart from McKinsey and Company shows characteristics of stablecoins.

Source: McKinsey & Company

High level takeaways from the GENIUS Act:

- Stablecoins are not securities with oversight by banking and payment regulators and not the Securities and Exchange Commission.

- Issuers are required to fully back their stablecoins 1:1 with high-quality liquid assets such as U.S. Treasury Bills. Therefore, stablecoin issuers may be a growing demand source for U.S. Treasuries.

- Issuers may not pay interest on their stablecoins. Stablecoins serve as cash equivalents and are not interest-bearing savings accounts.

- The Act provides for regulations including audits, disclosures, issuer bankruptcies (stablecoins have priority claims from creditors), and anti-money laundering.

Stablecoin awareness and adoption is growing. It will likely impact the way people administer their financial transactions. Issuers of stablecoins are likely to be banks, fintechs, and large retailers who will facilitate money transfers and payments worldwide. Prominent companies have announced plans for their own stablecoins as payment options. Existing global intermediary “payment rails” such as Mastercard and VISA could be impacted leading to disintermediation in traditional banking and money transfer processes. In 2024, stablecoin transfer volumes exceeded $28 trillion, surpassing Visa and Mastercard combined.

In summary, stablecoins are not an investment. Their value is designed to remain constant, removing the prospect of capital appreciation. The role of stablecoins is anchored in transactions, not wealth creation. Still, their potential impact on the investment and financial universe is far from negligible.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).