Second Quarter Outlook

INVESTMENT COMMITTEE COMMENTARY March 2023

March began with investors remaining focused on inflation and potential interest rate hikes, but the sudden failure of Silicon Valley Bank, at the time the 16th largest bank in the United States, shifted investor focus to a potential banking crisis. Signature Bank of New York failed just days later which increased concerns. In response, the Federal Reserve (Fed) and the Treasury Department created new lending programs aimed at shoring up regional banks and preventing bank runs. Concerns about the health of the financial system persisted and those fears weighed on markets through the middle of March. While the Fed hiked interest rates again at the March meeting, policy makers signaled that they are close to ending the current rate hike campaign. That admission, combined with no additional stress to the banking system led to a rally in the S&P 500 Index during the final two weeks of March.

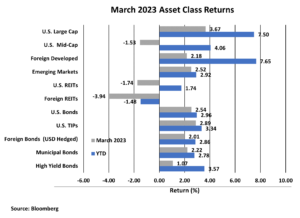

Most asset classes had positive returns in March. The S&P 500 Index gained 3.7%. Foreign developed and emerging market equities rose 2.2% and 2.5%, respectively. Mid-cap stocks and REITs, which have higher sensitivity to interest rates and the financial sector, fell in March.

In the fixed income asset class, falling bond yields contributed to positive performance. The yield on 10-year Treasuries reversed course from February and moved from 3.92% to 3.49%. As a result, the Bloomberg U.S. Aggregate Bond Index rose 2.5%.

Second Quarter Outlook

In the first quarter, markets continued to respond to the Fed’s rate hike cycle which targeted high inflation. Quick actions by government officials in response to regional bank failures helped to shore up bank liquidity concerns. Despite consistent comparisons in the financial media between the bank failures in March and the 2007-2008 financial crisis, there are important differences between the two periods. Of note, “global systemically important banks” hold nearly 2.5 times the capital than they did in 2008. While some bank issues remain, there is reason to hope this bank crisis has been contained.

As the second quarter begins, inflation remains a major longer-term influence on the markets and economy. Whether inflation resumes its decline this quarter will be very important for investors and the markets. More specifically, a resumed decline in inflation in the second quarter could provide a powerful tailwind for both stocks and bonds. The Consumer Price Index (CPI) is now at 6.0%, down from its high of 9.0% last June.

The Fed has signaled that it is close to ending the current rate increase cycle which would remove a material headwind on the economy. As long as expectations for rate hikes do not materially change, markets should be able to adjust to a higher, but more stable, interest rate environment. Cash yields are attractive today given current interest rates. Fixed income prospects appear to be favorable when referencing prior interest rate hiking cycles.

To be sure, it remains an uncertain time in the markets. Investors are facing inflation, the highest interest rates in decades, the worst geopolitical tensions in years, and a questionable economic outlook that deteriorated in the wake of recent bank failures. The U.S. manufacturing sector is decidedly slowing. However, underlying fundamentals including employment, consumer spending and corporate earnings have been surprisingly resilient. Markets may react to disconcerting geopolitical or financial headlines, but growth and earnings are key. Steady economic growth and strong earnings are the real long-term drivers of market performance.

Be prepared for continued volatility. At JMG, we are focused on managing both risks and return potential. A well-planned, long-term-focused, and diversified financial plan can withstand virtually any market surprise and related bout of volatility, including bank failures, multi-decade highs in inflation, high interest rates, geopolitical tensions, and rising recession risks.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).