The Role of Fixed Income in Rising Interest Rate Periods

INVESTMENT COMMITTEE COMMENTARY NOVEMBER 2021

Equity assets classes fell in November with the majority of the declines occurring in the last week of the month. Markets moved lower on the identification of a new coronavirus variant, Omicron, and investor uncertainty over its potential effects. In addition, the Federal Reserve (Fed) announced early in November intentions to reduce its accommodative policy by tapering its bond purchasing interventions. Also in his comments regarding Fed policy, Chairman Jerome Powell stated that factors pushing inflation higher will linger well into next year.

Of note, on the day after Thanksgiving, the S&P 500 had its largest daily decline (down 2.27%) since June 2020, largely attributed to news of the Omicron variant. Some stocks including Moderna, Pfizer, Zoom and Clorox had price gains while airlines, hotels and oil / gas stocks fell sharply. Considering all sectors together, the market did not reach short-term extreme oversold levels, but sentiment indicators have fallen.

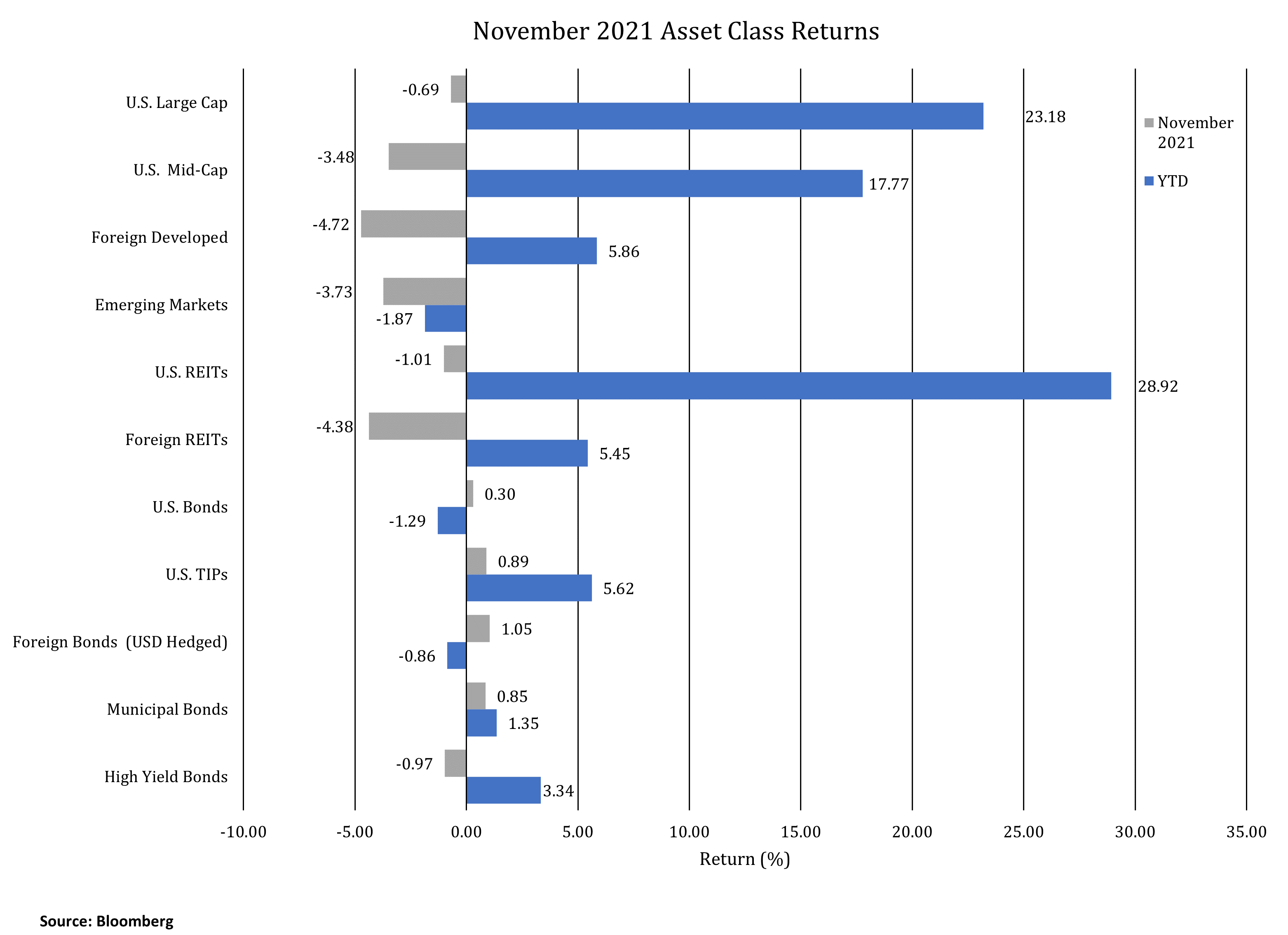

In November, the S&P 500 fell 0.7% although the year-to-date total return remains positive at 23.2%. Other equity asset classes generally had somewhat steeper declines, down by approximately 3% to 4%. Bond performance, except for the high yield bond asset class, was positive in November as the yield on 10-year U.S. Treasuries fell from 1.56% to 1.44%. U.S. Treasury Inflation Protected Securities (TIPS) continued to have a positive return in 2021 as inflation expectations have moved higher.

Looking ahead, the principal drivers of equity market performance will be the economic effects from the severity of and government response to the Omicron variant and whether persistent inflation causes the Fed to raise interest rates sooner than expected.

The Role of Fixed Income in Rising Interest Rate Periods

Bond prices fall when interest rates rise and vice-versa. From August 2020 to March 2021, interest rates rose by more than 1% from historically low levels as economies reopened and inflation pressures rose. With prospects for future interest rate increases, some investors are questioning whether to reduce or abandon bonds in a rising interest rate environment.

The following are observations regarding common investor concerns in rising rate environments:

- For a long-term investor in fixed income, the principal investment objectives are income/total return, equity diversification, and capital preservation. This differs from the principal investment objective of equities which is to generate strong risk-adjusted real returns. Fixed income and equities play different roles in investment portfolios.

- Low starting fixed income yields generally imply lower future returns. Long-term fixed income investors want interest rates to move higher to a reasonable equilibrium level. The immediate negative price impact of a rate increase is more than offset by the ongoing returns from higher interest. Steady rate increases are easier for markets to absorb relative to rapid interest rate shocks.

- Equity diversification is an important reason why JMG recommends fixed income allocations for most clients. When stocks are falling in a risk-off market, bonds can act as a shock absorber in such periods. While low yields may imply bonds have less room to rally, diversification at low interest rates is possible. As noted above, on November 26th the S&P 500 dropped by 2.27%. Also on that day, bonds demonstrated their diversification benefits. The Bloomberg Aggregate Bond Index and TIPS actually gained 0.75% and 0.52%, respectively.

- Abandoning or reducing a fixed income allocation implies an element of market timing that interest rates and inflation can be predicted and consistently acted on profitably. Today, most investors understand the economic environment is signaling higher interest rates and inflation pressures. Therefore, higher interest rates and rising inflation are already factored into bond prices. Due to the size and structure of bond markets, it is possible for active fixed income managers to find points of opportunity to add return and provide a cushion from low yields.

- JMG recommends clients maintain a cash reserve based on individual circumstances, but we generally do not recommend going to cash to avoid duration (interest rate) risk. The expected longer-term returns of fixed income are higher than cash returns which are at, or near, zero.

- A concern with the fixed income asset class is whether bonds today can generate positive returns after inflation. In the short-run, this is unlikely to occur. However, if equities are performing well, as they are this year, clients are rewarded with the strong real returns from equities. Bonds supply risk management and perhaps some positive returns through the various fixed income sectors and active management.

If you have any questions, you should consult with your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg US Aggregate Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bonds (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).