Navigating Volatile Markets

INVESTMENT COMMITTEE COMMENTARY January 2022

After a strong 2021, equities opened the year with negative performance. Besides ongoing COVID-19 concerns, investors worried about impending interest rate hikes and asset purchase tapering by the Federal Reserve (Fed). Following the Fed’s two-day policy meeting that concluded on January 26th, Chairman Powell issued a statement indicating policy reversals away from the “very highly accommodative monetary policy that was put in place to deal with the pandemic”. While short-term interest rates rose after Powell’s comments, the Fed’s moves were not a surprise. Market volatility increased, but there was not panic selling as the Fed policies were telegraphed well in advance. Accommodative Fed policy helped fuel strong equity markets for the last several years.

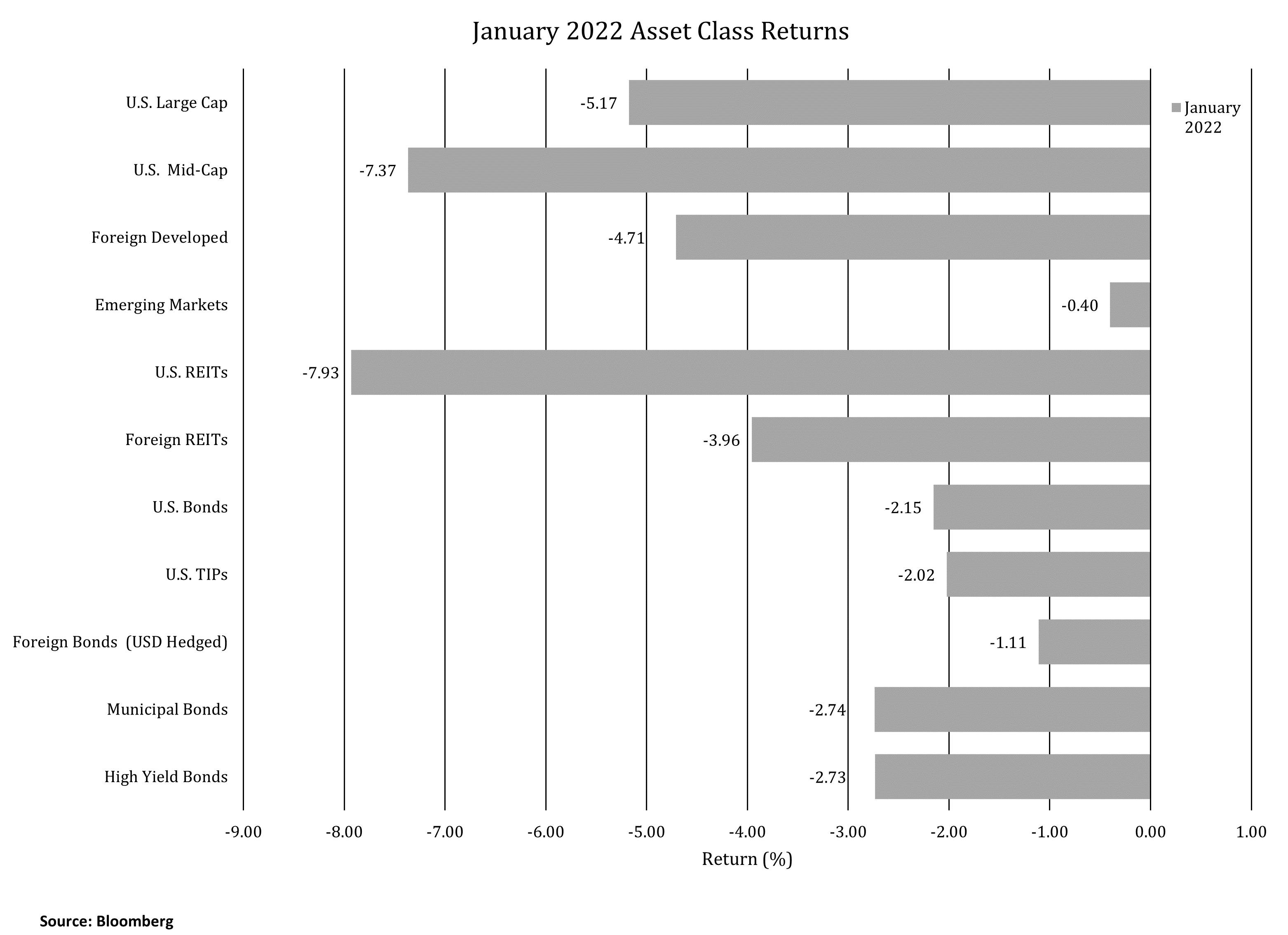

For January, the S&P 500 fell 5.17%. Mid-cap stocks performed even worse. The foreign developed asset class also had negative results, down 4.71% due to central bank policies and also Russia / Ukraine tensions. Emerging markets performed relatively better, down 0.40%.

Fixed income performance in January was weak, in line with increasing interest rates. The yield on 10-year U.S. Treasuries rose from 1.51% to 1.78%. Intermediate duration bonds generally had negative returns in January, but with relative performance better than equities.

Navigating Volatile Markets

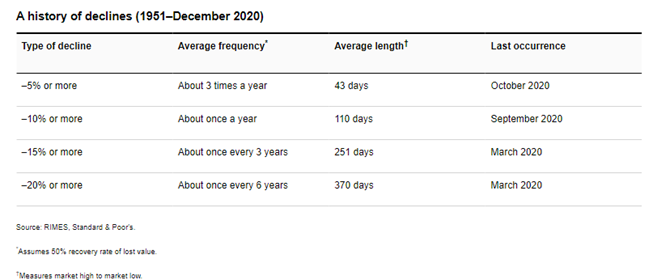

Volatile markets are normal and occur frequently.

Capital Group reports the following history regarding the frequency of S&P 500 declines:

Given that markets will be volatile due to unknowns and uncertainties, investors should expect such periods and maintain discipline in their investment plans based on their unique financial goals.

- Price movements should be viewed as opportunities to enhance portfolios rather than determining when it is time to “abandon ship”. Market declines may provide an opportunity to deploy capital at lower prices.

- The stock market can decline for days or months and it is natural that long drawdown periods can be frightening. However, every S&P 500 drawdown has ultimately been recovered by future performance. The key is to maintain sufficient cash and diversified assets to be in position to rebalance rather than being a forced seller during a market decline.

- Financial data is important for investors, however, investors need to be wary of multitudes of predictions regarding the Fed, GDP, valuations, trending investments, or the news item of the day. Tune out the noise, especially on wild trading days.

- Strong investment plans focus on diversification, asset allocation, tax efficiency and lower investment costs.

- Investors need to weigh the trade-off between potential returns and the risks assumed. Higher risk strategies, by their nature, are harder to stick with in turbulent environments.

Please contact your JMG advisor with questions or concerns.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg US Aggregate Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bonds (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).