Mid-Year Commentary

INVESTMENT COMMITTEE COMMENTARY June 2023

June was a strong month for stocks. The Federal Reserve (Fed) did not raise interest rates in June. Instead, the Fed opted to step back and assess additional information. Inflationary pressures showed signs of cooling with the twelve-month Personal Consumption Expenditures Index (PCE) coming in at 3.8%. The Consumer Price Index (CPI) had its smallest increase since March 2021, rising at an annual rate of 4.0%. Gross domestic product (GDP) reported a stronger-than-expected 2.0% in the first quarter. Also helping equity performance was a stress test on the largest U.S. domestic banks which indicated they are sufficiently positioned to continue lending to households and businesses, even during a severe recession.

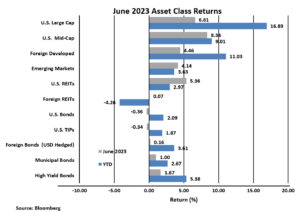

The S&P 500 gained 6.6%. All U.S. equity sectors advanced in June, but unlike prior months where the technology sector led performance, the strongest performance in June came from the consumer discretionary, industrials, and materials sectors. Foreign developed and emerging markets equities gained 4.5% and 4.1%, respectively. Mid-cap stocks and U.S. REITs had improved performance, notably the monthly return for U.S. mid-caps was 8.4%.

Rising bond yields produced modestly negative performance for investment grade bonds. The yield on 10-year Treasuries rose from 3.64% to 3.81% resulting in the Bloomberg U.S. Aggregate Bond Index return falling 0.4% for the month. Municipal bonds and high yield bonds both had positive returns in June.

Mid-Year Commentary

The S&P 500 ended the first half of 2023 at a 14-month high. Most major stock indices logged solid gains in the second quarter following a pause in the Fed’s rate hike campaign, strong corporate earnings (especially in the tech sector) and the relatively drama-free resolution of the debt ceiling.

- U.S. equity markets are trading at their highest valuation in over a year. Investor sentiment has turned suddenly, and intensely, optimistic. The markets took regional bank failures in stride as the Fed took measures in March to manage bank risks. The collapse of First Republic Bank caused minimal volatility in the second quarter.

- The strong S&P 500 performance in 2023 is mostly due to a small number of companies, particularly technology companies, riding the tech / artificial intelligence (AI) investor wave. Therefore, U.S. market breadth is quite narrow. The top ten stocks now make up 32% of the S&P 500 index while contributing just 22% of the index’s earnings. The price/earnings multiple on those top 10 stocks is a lofty 29.3, while the other 490 companies in the index trade at a more reasonable 17.8 multiple.

- Foreign developed equities also had strong performance in the first half of 2023. In contrast, valuations are lower relative to S&P 500 companies. The price/earnings ratio of foreign stocks is currently 12.9 times earnings. The European economy has been slowing with the ongoing backdrop of the war in Ukraine contributing to the lower market multiple.

Commentary on Key Economic and Market Issues

Inflation – Progress has been made in bringing inflation down, as year-over-year CPI has fallen from 9.1% to 4.0% over the last year. However, even at 4%, CPI remains above the Fed’s 2% target. If inflation bounces back, or fails to continue to decline, then the Fed could easily hike rates further, like the Bank of Canada and Reserve Bank of Australia did in the second quarter, following pauses of their own. Higher rates would weigh further on economic growth.

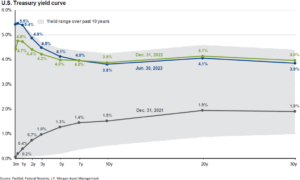

Interest Rates – The interest rate environment of 2023 is very different from a year ago. The chart below contrasts the dramatic increase in interest rates in 2022 with the inverted yield curve of 2023 exhibiting more stable interest rates, especially the longer duration yields.

Some market forecasters had been expecting the Fed to begin cutting interest rates in the second half of 2023. Now, with strong employment conditions and the economy still growing, that seems unlikely. Fed policymakers will continue to fight inflation as a higher priority and will not cut rates unless the employment situation dramatically deteriorates, and recession is more imminent.

Recession – The global economy has shown notable resilience this year, with economic momentum not only remaining positive, but also accelerating throughout the first half of 2023. Numerous factors appeared to set the stage for a more prosperous year. China, the world’s largest contributor to global growth, ended its zero COVID policy, unseasonably warm weather in Europe prevented the region from succumbing to a more dire energy scenario, while strong job markets globally and excess savings have continued to fuel consumer spending.

Global economic activity as measured by the Global Composite Purchasing Manager’s Index (PMI) is showing signs of slowing in many regions and countries. PMI readings above 50 indicate economic expansion while readings below 50 indicate economic contraction. In the U.S., PMI fell slightly in June from a level of 54.3 in May to 52.3. Similar falling PMI readings in Europe and China are not signaling robust global growth. While the risk of a global recession may have declined for 2023, economic growth is slow and has taken a step back.

Summary and Outlook

As we begin the second half of 2023, the outlook for stocks and bonds is arguably the most positive it has been since late 2021. Inflation hit a two-year low, economic growth and the labor market remain impressively resilient, the Fed has temporarily paused its historic rate hiking campaign, the debt ceiling extension is resolved, and there seems to be no significant contagion from the regional bank failures earlier this year.

This improvement in the fundamental outlook has been reflected in both stock and bond prices so far this year, as the S&P 500 hit the best levels since last April. Additionally, more cyclically focused sectors led markets higher late in the second quarter on rising hopes for a broad economic expansion.

However, while clearly the past quarter brought positive developments in the economy and the markets, it is important to remember that potentially significant risks remain. The market has taken a decidedly positive view on the ultimate resolution of multiple macroeconomic unknowns, but their outcomes remain very uncertain and thanks to the strong year-to-date rally in stocks, there is little room for disappointment.

The economy has not yet felt the full impact of the Fed’s historically aggressive interest rate hike campaign, and while the economy has proved surprisingly resilient so far, we know from history that the impacts of rate hikes can take far longer than most expect to impact economic growth. Second, excess savings, which have provided a needed buffer to consumer spending, are rapidly depleting and are not likely to contribute to spending much beyond year-end. It is premature to think the economy is “in the clear” from recession risks.

Finally, regarding the equity markets, the sudden burst of investor enthusiasm needs to be considered in the context of what is a still uncertain macroeconomic environment. Markets no longer have the protection of low expectations and valuations to cushion declines. Clearly, there have been positive macro developments so far in 2023 that have helped the stock market rebound. However, it’s important to remember that multiple and varied risks remain for the economy and markets.

While we remain cautious about domestic equity valuations in the current market environment, we are comforted by the more attractive valuations in the broader U.S. market and in foreign markets. Bond yields are also reasonably attractive and should provide a level of protection in the event of an equity market decline.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).