Investor Expectations – Out of Step with Federal Reserve Outlook

INVESTMENT COMMITTEE COMMENTARY January 2023

Both stocks and bonds began the new year with strong returns. Recent economic data indicates progress in lowering inflation although it will take a while to achieve the Federal Reserve’s (Fed) target inflation rate of 2%. Wall Street remains hopeful the economy can weather more interest-rate hikes by the Fed designed to fight inflation.

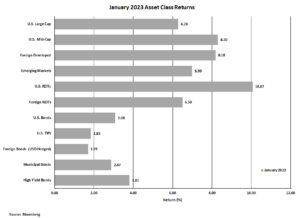

In January, the S&P 500 gained 6.3%. Fourth-quarter corporate earnings were generally favorable, however not as strong as the same period last year. Of the roughly 100 S&P companies that have reported fourth quarter results, total earnings are down about 6.0% compared to a year ago. Overall, earnings are expected to be down 7.2%. Corporate earnings will be an important determinant of 2023 stock performance. Cost cutting strategies will play a role in how well companies can manage earnings through a slowing economy.

Foreign developed and emerging market equities rose 8.2% and 7.0%, respectively, as foreign stocks benefited from a falling U.S. dollar. In the real estate asset class, after a challenging 2022 when REITs repriced quickly on rapid interest rate hikes, U.S. REITs posted a solid monthly return of 10.0%. Real estate fundamentals have improved based on well-below average supply growth and on the effects of disinflation.

Bonds also performed well as the yield on 10-year Treasuries fell from 3.88% to 3.52%. As a result, U.S. intermediate investment grade bonds gained 3.0%. The Treasury yield curve remains inverted, with the yield on one-month bonds at 4.58%, while the 10-year bond yield sits at 3.52%.

Investor Expectations – Out of Step with Federal Reserve Outlook

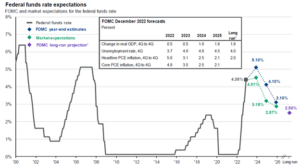

The strong January investment performance was due, in part, to investors discounting the Fed’s hawkish forward guidance. The Fed raised the fed funds rate by 0.50% in December and another 0.25% on February 1st with guidance that the Fed expects further rate hikes to move inflation back to the Fed’s 2% target. The Fed has raised interest rates 4.5% in the last year. The most recent consumer price index (CPI) reading is 6.4% and Chair Jerome Powell recently said that “substantially more evidence” is needed on inflation for the Fed to assess the permanency of inflation moderation. The full effect of rate hikes can take 12 to 18 months to impact the economy and so a portion of the Fed rate hikes have not yet been felt.

Investors seem to have a more optimistic outlook as shown by comparing the green and blue lines on the chart below. The market expects the Fed to pause or pivot sooner so that the damage to economic growth is mitigated. Effectively, investors are “fighting the Fed”. With improved investor sentiment, the result was strong equity performance in January. And with slowing economic growth, some investors are expecting the Fed to reduce interest rates sooner. Therefore, longer-term bond yields fell in January and bonds also had strong performance.

Source: J.P. Morgan Asset Management – Guide to the Markets – U.S. Data are as of January 31, 2023

Data from Bloomberg, FactSet, Federal Reserve. Market expectations are based off of the respective Federal Funds Futures contracts for December expiry. *Long-run projections are the rates of growth, unemployment and inflation to which a policymaker expects the economy to converge over the next five to six years in absence of further shocks and under appropriate monetary policy. Forecasts are not a reliable indicator of future performance. Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecasts, projectio0ns or other forward-looking statements, actual events, results or performance may differ materially from those reflected or contemplated.

It remains to be seen if the Fed or investors have the proper economic assessment for 2023. If investors are right, then markets would more likely continue to perform well. If the Fed holds to its policies and continues to raise rates above investor expectations, markets could fall back. Everyone can agree that restoring price stability is essential. We agree with Chair Powell that the disinflationary process is in an early stage and it will take time for inflation to moderate, especially in some service sectors of the economy.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).