Investments in U.S. Real Estate Investment Trusts (REITs)

INVESTMENT COMMITTEE COMMENTARY February 2024

Stocks ended February on a high note with the S&P 500 and Nasdaq 100 notching all-time highs. Technology companies, particularly those linked to artificial intelligence (AI), helped drive stocks. Inflation data released at the end of the month was in line with expectations, which also supported stocks. February’s gains marked the fourth straight month of advances for the S&P 500 while U.S. mid and small cap stocks recouped January losses.

Inflation data showed price pressures remained marginally elevated, driven higher by rising prices for services. However, the rate of inflationary growth for the 12 months ended in February slowed, according to the personal consumption expenditures (PCE) price index. Core PCE rose 2.4%, nearing the 2.0% target set by the Federal Reserve. The U.S. economy, as measured by gross domestic product, continued to show strength in the fourth quarter of 2023. Consumer spending was strong, reflecting greater confidence that inflation is coming down. This should lead to increased spending power, especially where incomes are also rising.

With the reporting of fourth-quarter corporate earnings mostly complete, the earnings growth rate for the S&P 500 was 3.2%, marking the second straight quarter of year-over-year earnings growth, according to FactSet. The revenue growth rate for the S&P 500 in the fourth quarter was 4.0%.

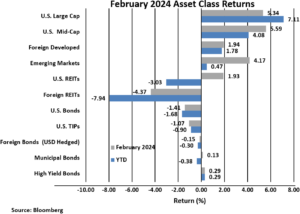

The S&P 500 rose 5.3% in February. Foreign developed and emerging market equities had more modest gains of 1.9% and 4.2%, respectively. U.S. REITs increased 1.9% although foreign REITs fell by 4.4%. REITs are sensitive to interest rate changes and performance of the asset class has more recently lagged other equity sectors.

Bond prices dropped in February as longer-term interest rates moved higher for the second straight month. The yield on 10-year Treasuries rose from 3.99% to 4.25%. With this increase, the Bloomberg U.S. Aggregate Bond Index fell 1.4% during the month. High yield and municipal bonds posted modest gains.

Investments in U.S. Real Estate Investment Trusts (REITs)

Rising interest rates can create headwinds for financial and real estate markets. REITs have recently faced a number of challenges as the Federal Reserve (Fed) tightened monetary policy throughout 2022 and 2023 resulting in higher interest rates. In 2023, with a strong finish at year-end, REITs total return was 11.4%.

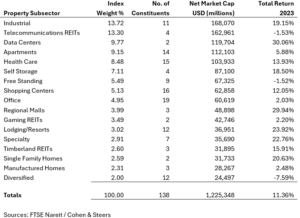

When people think about real estate, they often think about residential apartments, industrial buildings, commercial office properties, shopping centers and/or malls. However, such real estate sectors make up only about 37% of the FTSE Nareit All Equity Index, an index that spans commercial real estate across the U.S. economy with exposure to all investment and property sectors. Investors have been concerned about vacancies in some commercial office buildings across the country and have been hesitant to maintain REIT allocations. Of note, data centers and telecommunication REITs (cell towers) are significant REIT sectors. Surprisingly, self-storage REITs with an index weighting of 7.1% surpass office REITs which have a weighting of 5.0%. The chart below shows the constituents of the complete index. As can be seen by the displayed 2023 subsector performance, strong performance can be earned in other real estate subsectors, such as data centers. JMG recommends an allocation to REITs as the various types of real estate are diversifying and can generate positive cash flow to investors.

FTSE Nareit All Equity REIT Index

Representative of the U.S. Real Estate Market

REITs Looking Ahead

The following are additional items we consider in recommending REITs as a strategic asset class.

- In 8 of the last 20 years, the REIT index has increased by over 20%. In 3 of the last 20 years, the index has dropped by over 10%. Considering the three down years, two were in the financial crisis of 2007 – 2008 and the third was in 2022 due to inflation and interest rate increases. Looking forward, real estate companies are in a much stronger financial condition than during the financial crisis and the Fed is likely done with further monetary policy tightening. Historically, REITs have performed well following tightening cycles. The market conditions that previously caused the weakest REIT performance are less present today so future performance can improve.

- Ten year rolling returns for REITs show that long-term performance compares favorably with other risk asset classes and offer competitive total returns. REITs can provide attractive current income as REITs have minimum payout requirements based on strong cash flows. REITs also offer diversification benefits because they don’t always move in sync with the broader equity market.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).