Intra-Year Market Declines and Recoveries

INVESTMENT COMMITTEE COMMENTARY April 2022

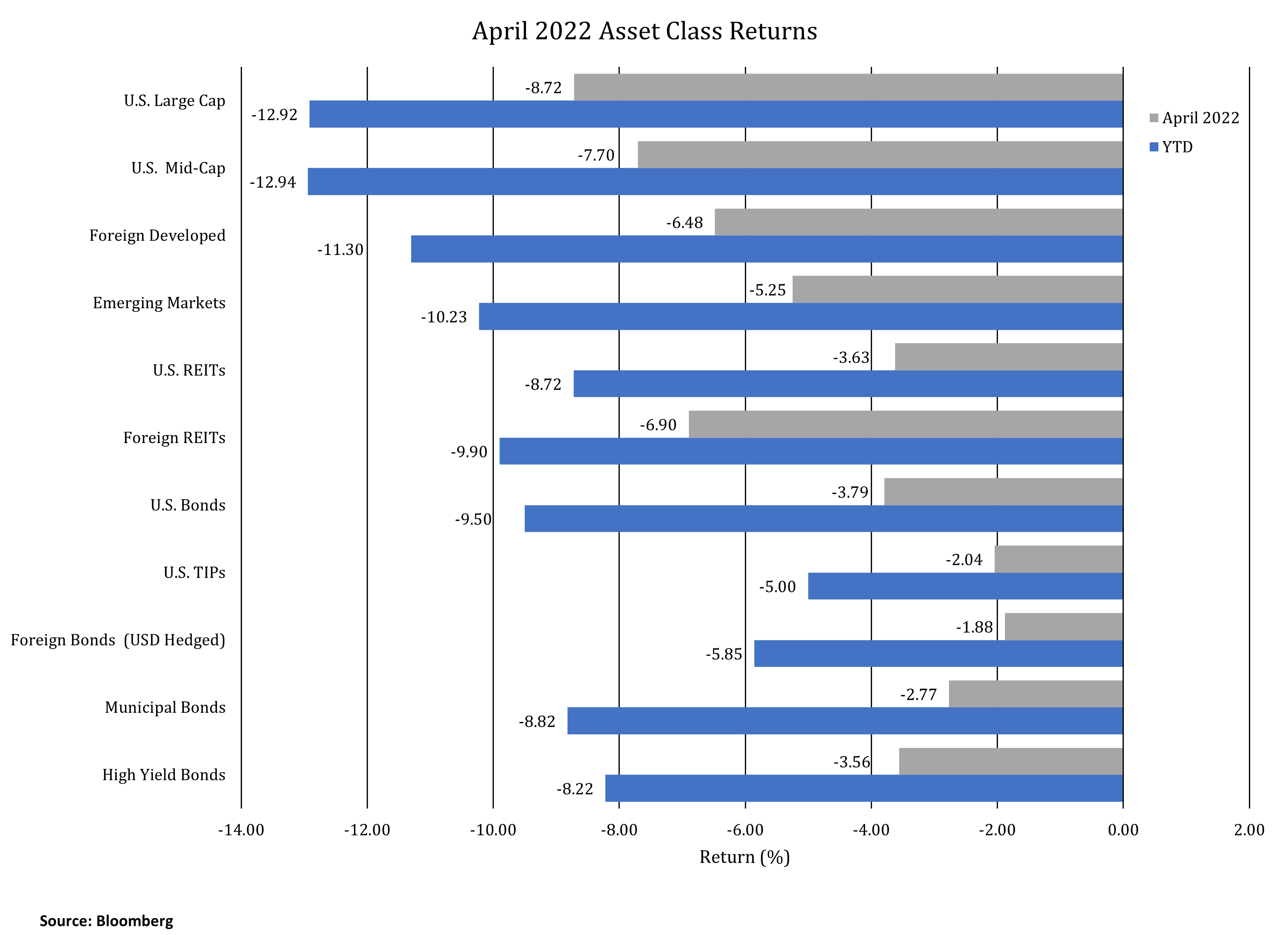

Equity and fixed income asset classes declined in April. Rising interest rates and inflation, the war in Ukraine, and COVID lockdowns in China all created uncertainty, resulting in weakness in the equity and fixed income markets.

During the month, the yield on 10-year Treasuries rose from 2.33% to 2.89%. The Federal Reserve signaled it is in the early stages of tightening monetary policy. Interest rates have risen as the market is anticipating future inflation and associated Fed interest rate increases. The recent 0.50% increase in the fed funds rate was the first rate increase of that magnitude since 2000.

Underlying inflation data remains concerning. Headline CPI is reported based on year-over-year changes: for example, prices in April 2022 are compared to prices from April 2021. The latest CPI reading is 8.6%. More concerning is that inflation is not expected to abate soon. The gasoline and food components, which make up about 20% of CPI, are alone expected to contribute 3.1% to inflation for the foreseeable future, well above the Fed’s 2% target. CPI rent components are above 4% and medical care inflation is at 2.9%. Based on this data, the Fed will continue to tighten monetary policy sooner and quicker than what was previously forecast. Under this approach, the Fed is hoping inflation will not continue to accelerate but subside gradually over time.

The initial estimate for first quarter gross domestic product (GDP) showed a decline of 1.4% following a 6.9% increase in the fourth quarter of 2021. This decline may be explained more by geopolitical events such as the war in Ukraine and COVID lockdowns, particularly in China. S&P 500 corporate earnings are expected to rise about 7% in the first quarter which is positive, but lower than recent quarters. Earnings from some notable growth companies, including Amazon, Apple, and Netflix, disappointed investors. The result was higher market volatility and negative returns for both stocks and bonds.

In April, the S&P 500 declined 8.7% and U.S. REITs fell 3.6%. Foreign developed stocks and emerging markets dropped 6.5% and 5.3%, respectively. Investor sentiment remains negative.

Intra-Year Market Declines and Recoveries

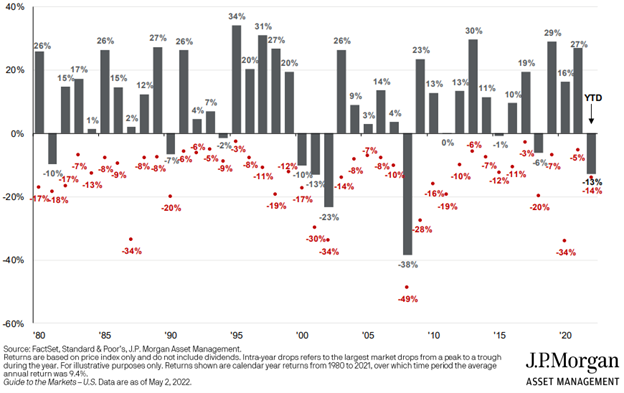

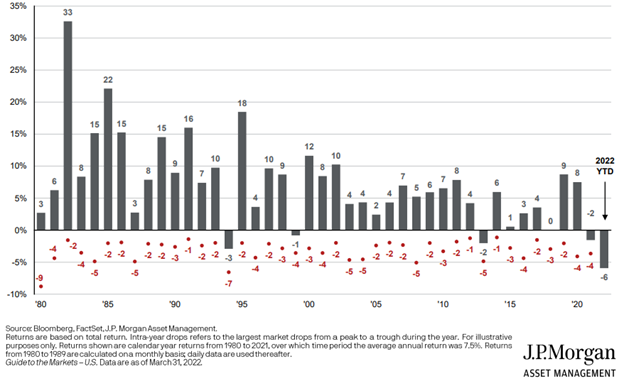

During market drawdowns, it is important to stay disciplined and diversified. Through these periods, we prefer neutral asset allocations because short term volatile market swings are difficult to predict. The following charts illustrate historical intra-year market declines and recoveries.

S&P 500 intra-year declines vs. calendar year returns – Despite average intra-year drops of 14.0%, annual returns were positive in 32 of 42 years. This year’s decline through April is quite consistent with prior year drawdowns.

Bloomberg US Aggregate Bond Index intra-year declines vs. calendar year returns – Despite average intra-year drops of 3.2%, annual returns have been positive in 38 of 42 years.

Observations

It is rare for both stocks and bonds to experience negative quarterly returns of the magnitude experienced in the first quarter of 2022. In fact, the first quarter was one of the three worst quarters for stock / bond relative performance since 1976. Despite the negative performance so far this year, fixed income asset classes remain an important piece of a portfolio. Going forward, with yields increasing, bonds will produce more income, provide more protection from negative scenarios and provide higher total return performance.

From an equity standpoint, S&P 500 earnings growth remains positive. The equity market can recover from oversold conditions and interest rate yield pressure could ease as further Fed interest rate increases are significantly priced into the market. However, inflation and geopolitical news are likely to keep volatility at higher levels.

Our portfolios continue to hold asset classes such as REITs, emerging market equities and high yield bonds that have historically outperformed during periods of rising inflation.

Please contact your JMG advisor with questions or concerns.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg US Aggregate Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bonds (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).