Fixed Income Yields

INVESTMENT COMMITTEE COMMENTARY October 2022

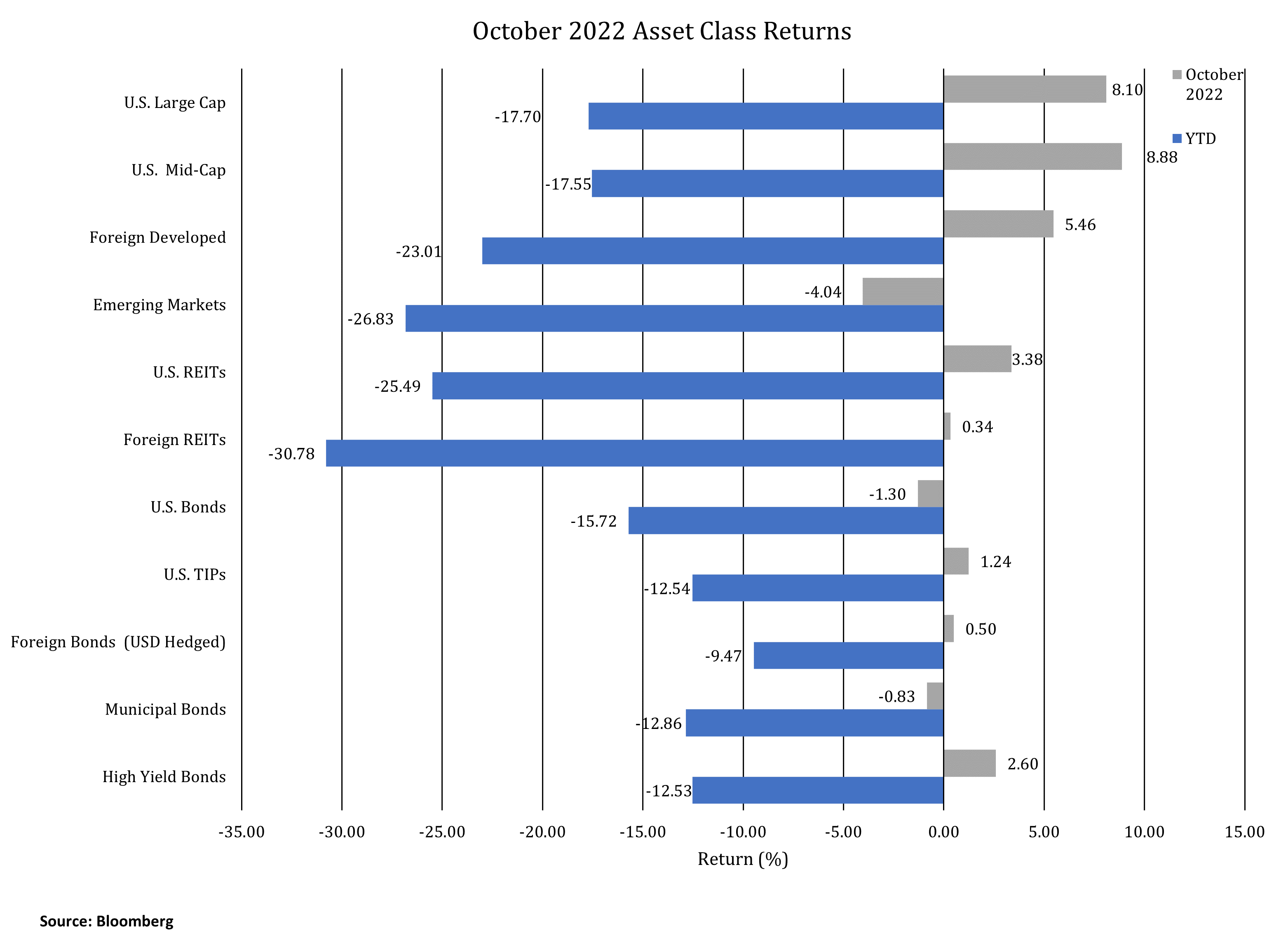

October saw stocks close higher, the first monthly gains since July. The S&P 500 rose 8.1% and foreign developed equities gained 5.5%. However, emerging market equities fell 4.0%, in part, due to the Chinese Communist Party granting President Xi Jinping a third five-year term as president and general secretary. This led to market concerns as to what extent China may continue its strict COVID lockdown policies and impede global trade. U.S. real estate investment trusts (REITs) gained 3.4% in October. For the month, the yield on 10-year Treasuries rose from 3.81% to 4.08%. As a result, intermediate investment grade bonds fell 1.3%. However, TIPS, foreign hedged bonds and high yield bonds posted modest gains in October.

Investors bought equities on hopes that inflation is moderating and will lead the Federal Reserve to slow its tightening policies. Unfortunately, Chairman Powell’s recent press conference did not indicate a Fed pivot. He said Fed rate hikes would continue to higher levels as deemed necessary to control inflation. Additionally, the ultimate level of interest rates could be higher than previously expected. This Fed language is not favorable to an immediate stock market rally.

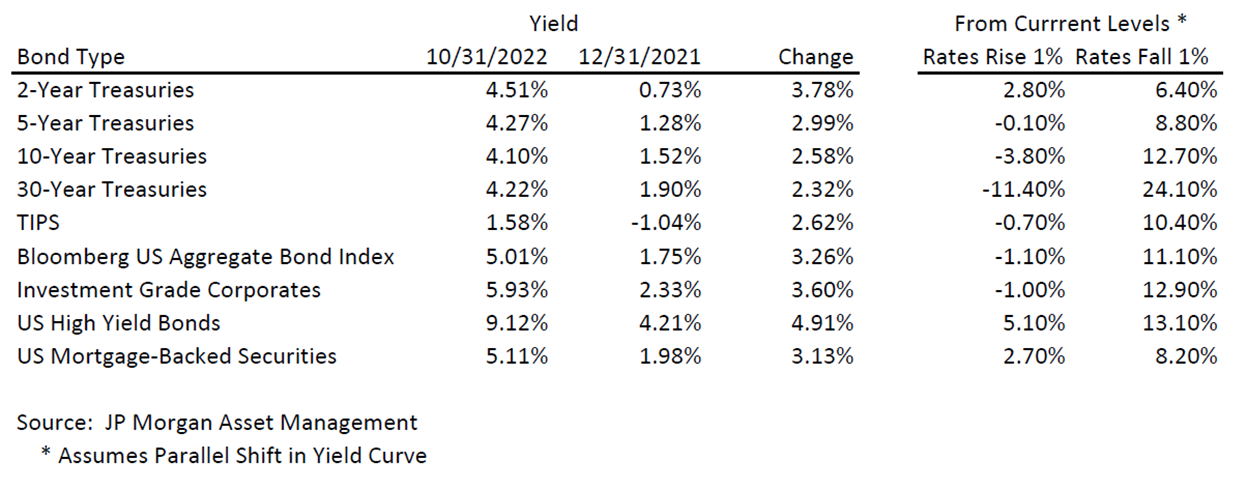

Fixed Income Yields Have Significantly Increased

Last month, we noted that it is very rare for stocks and bonds to both perform negatively in the same year. This year’s negative returns for each of these asset classes are due to various factors including the rapid increase in inflation and Fed interest rate changes which followed a decade of low or near zero interest rates.

At current yields, bonds are much more attractive than they have been in many years. They now offer attractive returns and better diversification from stocks on a go-forward basis. JMG utilizes an intermediate duration approach to our bond strategies to balance risk and return. Many investors are surprised to learn their intermediate duration bond funds are yielding more than 5% today.

The chart below shows better potential upside performance for bonds when comparing a 1% increase vs. 1% decrease in interest rates. There is significant upside potential for bonds when rates once again fall. Also, for certain bond types such as high yield bonds and mortgage-backed securities, positive return would be expected, going forward, even if rates rise another 1%.

This year’s returns have been poor for both stocks and bonds, and we recognize challenges for the global economy will continue. That said, we think the markets have digested these challenges in a reasonable fashion. We would not be surprised if the markets experienced continued volatility over the next six to twelve months, but we are comforted that current valuations for both stocks and bonds should offer attractive returns on a longer-term basis.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).