Monthly Economic News

Monthly Economic News

Demystifying Cryptocurrency

INVESTMENT COMMITTEE COMMENTARY FEBRUARY 2021

In spite of a sell-off in the final week, equity indexes reported positive performance in February. For the month, the S&P 500 gained 2.8% while U.S. mid-cap stocks had strong performance, up 5.6%. Foreign developed equities advanced 2.3%, and emerging market equities gained 0.8%. For February, U.S. and foreign REITs were up 2.7% and 2.2%, respectively. Year-to-date, equity indexes are now modestly positive through the first two months.

Fixed income performance was generally negative in February as longer-term interest rates moved higher. The yield on 10-year U.S. Treasuries increased from 0.93% to 1.44% over the last two months with most of the increase in February. The Bloomberg U.S. Aggregate Bond Index fell 1.4% in February. Municipal bonds and U.S. TIPS both fell by 1.6% for the month. Conversely, high yield bonds were up 0.4% in February. For the year, fixed income indexes are generally lower by 1% to 2%. Bond yields often increase in economic recoveries following recessions. Short-term interest rates remain near zero as the Federal Reserve continues to signal that it expects to keep short-term interest rates low.

Cryptocurrency and Bitcoin

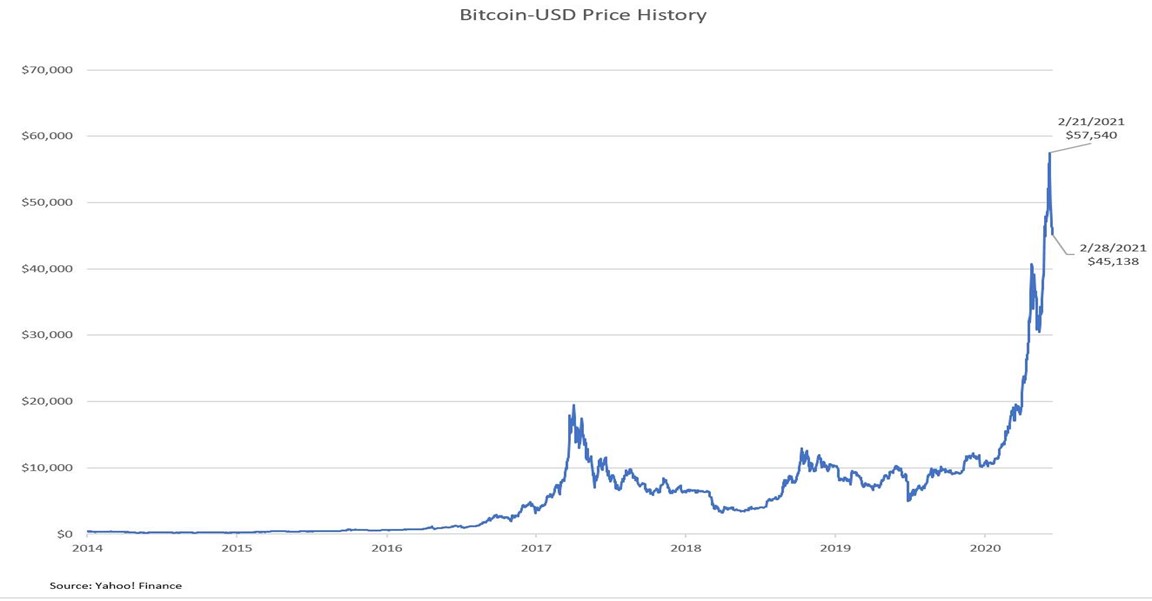

Bitcoin hit an all-time closing high of $57,540 on February 21st and reached a total market value in excess of $1 trillion. By reference, Bitcoin’s price on December 31, 2020 was $29,002 and on December 31, 2019 was $7,194. The chart below shows the price history of Bitcoin and why the recent price action is gaining attention.

Cryptocurrency is a medium of exchange generated using cryptography (encryption / secret coding) as a tool to secure a transaction and control the creation of units (coins). Unlike conventional currencies (dollar, yen, euro, etc.), cryptocurrency is decentralized. Cryptocurrency is not controlled by central banks and is not backed by any government. Instead, each party to a transaction individually manages their own ledger (electronic wallet). The most popular cryptocurrency is Bitcoin, which gained popularity in 2009. Since the introduction of Bitcoin, other cryptocurrencies have been formed, but Bitcoin is the most widely known.

One of the new developments of Bitcoin has been increasing adoption by merchants and institutions. Last October, PayPal announced it would allow users to buy, sell and hold bitcoins. Tesla made a substantial bitcoin purchase of about $1.5 billion in January as Elon Musk expects Tesla to accept Bitcoin payments in the future. Merchants with crypto partners are accepting or planning to accept bitcoins in some form including Microsoft, Home Depot, Starbucks, Expedia, AT&T, and the Dallas Mavericks.

While Bitcoin bears watching because of its apparent adoption by commercial interests and institutions, the following challenges lead JMG to not currently recommend including cryptocurrencies in portfolios.

- They do not generate cash flow like bonds or earnings tied to global economic growth.

- They do not provide consistent diversification benefits given unstable correlations.

- They do not dampen overall portfolio volatility.

- They do not show evidence of hedging against inflation.

- They may create a high level of tax compliance.

Individuals need to be aware of significant risks with Bitcoin. While some view Bitcoin as a store of value, there is no inherent intrinsic value and price volatility can be extreme. Treasury Secretary, Janet Yellen, has expressed concerns stating that Bitcoin is “extremely inefficient” as a way to conduct transactions. Also, regulation and tax compliance can be difficult. Taxpayers this year will see a new question on their tax returns asking if they have engaged in cryptocurrency transactions.

If you have any questions, please contact your JMG advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices.