Data Driven Markets and Changing Market Forecasts

INVESTMENT COMMITTEE COMMENTARY September 2023

Market volatility continued in September as rising bond yields pressured stock valuations, while some inflation indicators pointed to a bounce back in inflation and the Federal Reserve (Fed) reiterated a “higher for longer” interest rate outlook. All asset classes declined for the month.

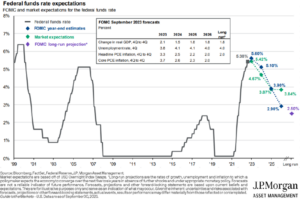

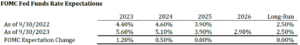

Solid economic data and a pause in the rise in Treasury yields allowed the S&P 500 to stabilize through the first half of the month. Volatility returned following the September Fed decision that gave investors a “hawkish” surprise, despite not increasing interest rates. Specifically, the majority of Fed members reiterated an anticipated need for an additional rate hike before the end of the year. Further, the Fed forecasted only two rate cuts for all of 2024, down from four rate cuts forecasted at the June meeting.

Late in the month, two additional developments weighed further on both stocks and bonds. First, the United Auto Workers labor union began a general strike, a move that would disrupt automobile production. Second, the U.S. moved towards another government shutdown as Republicans and Democrats struggled to agree on a “continuing resolution” to fund the government. The shutdown was avoided at the last minute, but the funding extension only lasts until November 17th. The S&P 500 declined towards the end of the month to hit a fresh three-month low.

The headline consumer price index (CPI) moved higher from 3.3% to 3.7%, as the gasoline component of CPI was impacted by a rally in global crude oil prices and with normal changes in supply and demand for gasoline. Other inflation components such as food at home, food away from home, medical care, used vehicles and airline fares may moderate, but in total, it will be difficult for CPI to move below 3% anytime soon.

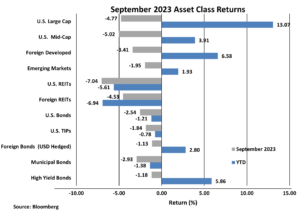

The S&P 500 fell 4.8% in September but remains up 13.1% for the year. Other domestic equity asset classes modestly underperformed the S&P 500 in September. Foreign developed and emerging market equities outperformed the S&P 500 even with a strengthening U.S. dollar which is a headwind for foreign stocks.

Rising bond yields impacted bond performance in September. The yield on 10-year Treasuries rose from 4.09% to 4.57%. This increase was higher than expected and the Bloomberg U.S. Aggregate Bond Index return fell by 2.5%. High yield bonds and foreign bonds (USD hedged) also declined in September, but year-to-date performance remains positive.

Data Driven Markets and Changing Market Forecasts

Over the last several years, the Fed has underestimated the rise in short-term interest rates. Two years ago, for example, the central bank forecasted a Fed Funds Rate for September 2023 of 0.25%. Last year, the forecasted 2023 rate jumped to 4.40%. The actual rate today stands at 5.33%. Revised forecasts continually provide new data points that factor into investor decisions. The following chart shows current Fed forecasts and illustrates changes from a year ago which reflect the upside interest rate surprises in 2023.

Investors, as a group, will digest and react to economic news and data as it relates to the markets. Investors also attempt to extrapolate that information to understand longer-term market implications. The recent news on inflation and interest rates has investors reevaluating their earlier optimism regarding a soft landing for the economy.

The problem with reacting to individual data points too intensely is that it can lead to a wrong conclusion. Consider that at the start of the year, high inflation data and soft U.S. economic growth led to widespread expectations of stagflation. However, stagflation has not materialized. The opposite occurred in July when markets fully embraced the “soft landing” narrative. This positive outlook proved premature.

Market sentiment can fluctuate quickly between “everything is great” to “everything is terrible” scenarios. For now, the market is seeing value somewhere in the middle, i.e., economic growth is generally stable, inflation is still declining (albeit more slowly than before) and the Fed is less hawkish than feared.

Fourth Quarter Market Outlook

Markets began the fourth quarter decidedly more anxious, but it is important to realize that while the S&P 500 did hit multi-month lows in September and there are legitimate risks to the outlook, underlying fundamentals remain generally strong.

First, while there are reasonable concerns about a future economic slowdown, the latest economic data remains solid. Employment, consumer spending and business investment were all resilient in the third quarter. While a future economic slowdown is certainly possible given higher interest rates, the resumption of student loan payments and declining U.S. savings, the actual economic data is clear: It is not happening yet.

Second, fears that inflation may bounce back are also legitimate, given the rally in oil prices in the third quarter. But the Federal Reserve and other central banks typically look past commodity-driven inflation and instead focus on “core” inflation and that metric continued to decline throughout the third quarter. Additionally, declines in housing prices from the recent peak are only now beginning to work into the official inflation statistics, and core inflation should continue to move lower in the months and quarters ahead.

Finally, regarding monetary policy, the Federal Reserve’s historic rate hike campaign is nearing an end. While we should expect the Fed to keep rates “higher for longer,” high interest rates do not automatically result in an economic slowdown. Interest rates have merely returned to levels that were typical in the 1990s and early 2000s, and the economy performed well during those periods. The risk of higher rates causing an economic slowdown is one that must be monitored closely, but for now, higher rates are not causing a material loss of economic momentum.

There are real risks to both the markets and the economy as we begin the final three months of the year. But these are largely the same risks that markets have faced throughout 2023 and over that period the economy and markets have remained resilient. We will continue to closely monitor market risks and our client investment portfolios.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).