Federal Government Shutdown

INVESTMENT COMMITTEE COMMENTARY September 2025

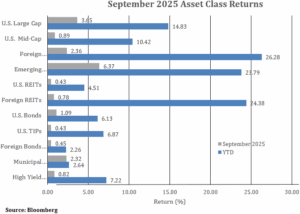

Major stock indices continued the 2025 rally and surged to new all-time highs in September as economic growth remained stable, tariff increases were no worse than feared and the Federal Reserve (Fed) cut interest rates, beginning the long-awaited rate-cutting cycle.

The recent equity rally continued despite growing signs that the labor market is seeing some deterioration. The August jobs report was underwhelming, showing just 22,000 jobs added for the month, well below the consensus estimate. However, the expectation for Fed rate cuts helped offset the negative employment report and the Fed did cut interest rates at the September meeting. Also, Fed members signaled they expected two more rate cuts this year. The start of a Fed rate-cutting cycle combined with strong artificial intelligence (AI)-related tech stock earnings from Oracle and Broadcom sent stocks to new all-time highs.

Emerging markets (EM) equities had strong performance in September increasing 6.4% for the month and are now up over 20% year-to-date. Key performance drivers are from stimulus measures in China and stabilizing political reforms in South Korea, Poland and Columbia.

The bond market continues to be influenced by Fed monetary policy, economic data, geopolitical events, and tariffs. Ten-year Treasury yields were relatively stable in September as investor expectations of Fed rate cuts were already priced into the market. The yield on 10-year Treasuries fell from 4.23% to 4.16%. The Bloomberg U.S. Aggregate Bond Index gained 1.1% for the month.

Federal Government Shutdown

The federal government is currently in a “shutdown” driven by a partisan divide in Congress over healthcare funding and extension of subsidies of the Affordable Care Act which expire at the end of the year.

There have been 21 shutdowns since 1976, of which 7 lasted more than 10 days with the longest lasting 35 days. In these periods, people worry about how entitlement programs such as Social Security, Medicare and Medicaid will be impacted during the shutdown.

The federal budget divides government spending into three categories: mandatory spending, discretionary spending, and net interest.

The Urban-Brookings Tax Policy Center (TPC) describes mandatory spending as controlled by laws other than appropriations acts. Such mandatory programs continue from year-to-year without new authorizations. No action of Congress is required for mandatory programs to continue. Therefore, the government shutdown should not impact mandatory programs such as Social Security, Medicare or Medicaid. If one is qualified for any of these entitlements, they should receive their benefits throughout the shutdown. In the fiscal 2025 federal budget, 59% of the budget is mandatory spending.

Net interest is another category of mandatory spending. The federal government must service its debt and in the fiscal 2025 federal budget, 14% of the budget is net interest.

In combination, mandatory spending and net interest makes up 73% of the federal budget and these will be paid during the shutdown with no action required by Congress.

The remaining 27% of the federal budget is discretionary spending. TPC notes that discretionary spending, set in annual appropriations acts, includes most defense programs as well as spending for education, transportation, environmental protection, law enforcement and border security, international assistance, and a host of other programs. Almost half of discretionary spending relates to defense. In the past, critical federal functions such as air traffic control and the post office were generally not affected although compensation to government workers could be deferred. “Nonessential” government activities such as national parks and museums have been closed.

Regarding stock and bond market returns during shutdowns, history gives no clear relationship between shutdowns and either stock or bond returns. Of note during the longest shutdown that ended in January 2019, the S&P 500 rose 9.3% over that 35-day shutdown period. Mixed historical results mean that investors cannot know how markets will react during a government shutdown. Maintaining a long-term asset allocation and rebalancing if market volatility rises provides a prudent plan during shutdown periods.

Fourth Quarter Market Outlook

Markets begin the final quarter of 2025 in an optimistic market backdrop as the Fed is cutting interest rates, tariffs have not disrupted the U.S. economy (so far), broader economic growth remains stable and investment enthusiasm for AI-linked stocks remain high. Those factors propelled stocks steadily higher throughout the third quarter, added to already-solid year-to-date gains for major U.S. stock indices and boosted investor enthusiasm.

However, while the current market environment is positive, it should not be confused with a riskless environment and continued gains in stocks are not inevitable. And as always, there are risks to the markets and economy we continue to monitor.

First, the labor market is deteriorating and that may be a sign of a broadly slowing economy. Numerous employment indicators, in addition to the monthly jobs report, are signaling a loss of momentum. For now, they are not at levels that would indicate a reversal in overall U.S. economic growth, but if we see the unemployment rate continue to rise, investors will become more concerned about the state of the U.S. economy and that could be a negative influence on the markets.

Additionally, inflation remains stubbornly high. Headline CPI remains just under 3.0%, above the Fed’s 2.0% target. Meanwhile, tariffs are now starting to impact broader parts of the U.S. economy and while analysts generally believe tariffs will produce only a one-time price increase and not create broader inflation, that outcome remains uncertain. There is a chance that tariffs further boost inflation in the fourth quarter and that could result in the Fed having to reconsider future rate cuts, which would produce a negative surprise.

Finally, AI and tech enthusiasm has driven the valuation of the S&P 500 to a historically high level. While elevated valuation, by itself, is not a negative influence on stocks, the high valuation does underscore this reality: A lot of profit growth is priced into the largest tech stocks and if this profit fails to materialize, these valuations will become unsustainable.

For clarity’s sake, consider the scenario which is being priced into the markets.

- AI is viewed as a transformative technology, which is going to make companies and people massively more efficient.

- AI providers are building the capacity to provide data processing and analytical capacity to companies and individuals who will be willing to pay for these services.

- The amount individuals and companies will be willing to pay for AI services depends on the scale of the efficiencies.

- If the efficiencies are great enough, across a broad enough portion of the economy, the AI companies will be able to increase revenue, and the individuals and companies using the AI will also become more efficient and profitable.

The risk is that these efficiencies do not materialize at the breadth, scale, or timeframe anticipated.

- If non-AI companies do not experience the efficiencies, and therefore will have lower than expected improvement in profitability.

- If non-AI companies are not willing to pay as much for AI services as projected, this will reduce the revenues for AI providers.

- If the timeline is extended, it is possible that early data centers will become obsolete as new technologies are developed, increasing costs as AI providers upgrade their platforms to stay competitive, which will in turn increase costs to the users, and reduce the efficiency realized.

While equity markets are indeed at high levels, there is a reasonable thesis for how and why recent stock prices make sense. The U.S. stock market has become heavily concentrated in a handful of stocks driven by the AI theme, with just 10 companies making up approximately 40% of the S&P 500’s total value. We continue to monitor this situation and consider whether, when, and how to mitigate this risk.

In sum, the macroeconomic environment is currently positive as the economy and markets are benefiting from interest rate cuts, fiscal stimulus (via the One Big Beautiful Bill Act) and continued investor enthusiasm for AI-linked stocks. But we also recognize that risks remain in the periphery of both the markets and the economy.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).