Mid-Year Commentary

INVESTMENT COMMITTEE COMMENTARY June 2025

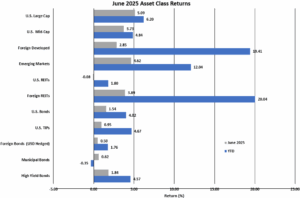

Wall Street has come a long way from its April sell-off as investor optimism over trade agreements and events in the Middle East helped lift stocks to record highs. Led by large cap growth companies, the S&P 500 had strong June performance, up 5.1%. Foreign developed and emerging markets stocks also rose in June gaining 2.9% and 4.6%, respectively. The dollar continued to tumble, hovering near its lowest level since early 2022. The falling dollar has been a tailwind to international and emerging market equities for U.S. investors.

Regarding inflation, the May consumer price index (CPI – released in mid-June) rose slightly to 2.4% year- over-year, with little progress since March. Core CPI, which excludes food and energy prices, held steady at 2.8%. The June Federal Reserve (Fed) meeting resulted in no change in the Fed Funds Rate. Chair Jerome Powell said that the Fed is “well positioned to wait” before dropping rates further. Markets continue to expect two rate cuts in 2025.

Gross domestic product (GDP) in the first quarter fell by -0.3% from the prior quarter, seasonally adjusted. This was a sharp decline from prior quarters and resulted from increased imports and inventories as companies made moves to get ahead of uncertain tariff costs. It is reasonable to think the negative GDP is a one-time negative reading (this time) due to the inventory component which is not expected to continue.

Underlying data in the July employment report gave indications of stress points that could lead to economic risks. The labor force has fallen by 755,000 people in the last two months. Private nonfarm payroll data shows very modest growth and weakness continues in manufacturing and wholesale trade (durable goods). Public sector federal employment jobs are not showing the massive declines that may have been inferred from the Department of Government Efficiency (DOGE) headlines earlier in the year. State and local government jobs increased by 80,000 in June over the prior month. With public sector jobs holding up better than expected but private sector jobs showing weakness, the Fed is weighing the uncertain employment data as it evaluates future rate cuts.

Bond prices in June rose as the yield on 10-year Treasuries fell from 4.41% to 4.24%. The Bloomberg U.S. Aggregate Bond Index (AGG) posted a 1.5% return for the month. The municipal bond sector recovered +0.6% in June but are still slightly down for the year.

![]()

Mid-Year Commentary

The S&P 500 ended the first half of 2025 near its all-time high. The following are factors that have driven overall market performance this year.

- Last year, large-cap growth stocks (including the ”Magnificent Seven”) drove S&P 500 performance. Inflation was subsiding but still high, and the markets were significantly driven by expected interest rate cuts by the Fed. In 2025, the S&P 500 has seen contributions from a wider range of sectors and companies, headline inflation has fallen relative to a year ago and the Fed has paused rate cuts.

- Market performance in the first half of 2025 has been a tale of two quarters. In the first quarter, increasing investor concerns from Trump Administration policies drove equity markets lower. Major policy action concerning tariffs, foreign affairs, immigration, and potential tax and spending legislation caused a heightened level of uncertainty for investors. With uncertainty comes market volatility. The S&P 500 fell through the end of the first quarter.

- The second quarter started with a proverbial thud when, on April 2nd, President Trump announced sweeping and substantial tariffs on virtually all U.S. trading partners. The tariff amounts were significantly larger than markets expected, and the announcement sparked fears of a trade-war driven economic slowdown. The S&P 500 dropped more than 10% in the days following the tariff announcement. The index bottomed on April 8 and, as the administration appeared to soften its tariff policy implementation, the market began a steady recovery that continued through the end of the quarter. A 90-day delay was declared where tariff rates on most trading partners would be just 10%, far below most reciprocal tariff rates. That delay was followed by more steps to reduce the tariff burden, including important exemptions for key imports such as smartphones, semiconductors, pharmaceuticals and computers. The delay in reciprocal tariff rates and key category exemptions gave investors some confidence that the trade war would not automatically cause a recession. That optimism, combined with solid first-quarter earnings, helped launch a second quarter stock market rally.

- It should be noted that the second quarter rally was also impacted by geopolitical concerns after Israel launched a massive attack on Iranian nuclear and military facilities. The hostilities between the two rivals caused oil prices to temporarily spike and halted the stock market rally in mid-to-late June. Investors had to consider the prospect of rising oil prices hurting economic growth and boosting inflation. However, market volatility was limited following U.S. strikes on Iranian nuclear facilities and a shaky ceasefire between Iran and Israel resulting in moderation of oil prices.

- In summary, numerous important factors impacted the markets in the first half of 2025. The stock market completed an impressive rebound from steep declines in early April. Corporate earnings remained strong and economic growth proved resilient, yet again, even in the face of geopolitical uncertainty and elevated policy volatility.

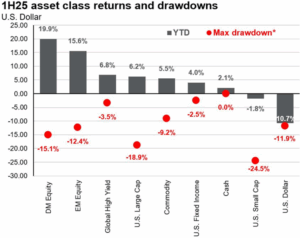

2025 Asset Class Performance and Observations

Broad diversification across asset classes has benefited investors in 2025. International and emerging market equities have dramatically outperformed U.S. equities so far this year. Fixed income returns have held up as 10-year Treasuries are trading at yields in a broad range of 4.25% to 4.5%, similar to a year ago. Overall, diversified portfolios have generated positive returns on both an absolute and inflation-adjusted basis, despite having experienced significant volatility along the way. The following chart shows year-to-date performance and maximum drawdowns from selected asset classes.

Source: J.P. Morgan Asset Management, Bloomberg, FactSet, NAREIT, FTSE Russell, Standard & Poor’s. Returns shown are total return as of June 30, 2025 unless stated otherwise. *Maximum drawdown for equities calculated using price return and reflects largest peak to trough drawdown during the year.

In reviewing the data above, we note the wide variances in performance which occurred over a short six-month period. One lesson to be learned is it is virtually impossible to time uncertain factors in a consistent and profitable manner. Staying invested for the long-term in a diversified manner generally adds value.

Third Quarter Market Outlook

The markets begin the third quarter following an impressive first half performance, as the S&P 500 hit a new all-time high despite larger-than-expected tariffs on U.S. imports, a dramatic increase in policy volatility and more hostilities in the Middle East. While the market was resilient over the past three months, it would be a mistake for investors to become complacent in this environment, because the economy faces meaningful risks and S&P 500 valuations remain elevated.

- First, while the market has assumed that tariffs will not rise substantially from current rates, there is no guarantee as to final negotiated tariff rates. To that point, the deadline for the reciprocal tariff delay is now August 1st and if that deadline is not extended, we could see tariff rates on major trading partners surge once again. Regardless, the reality is that global tariff rates are at multi-decade highs and it is still uncertain how that will impact the economy in the months ahead (so risks of a tariff-induced slowdown or rise of inflation cannot be dismissed).

- Turning to geopolitics, while the various conflicts have not negatively impacted global markets, risks remain elevated. If Iran takes steps to disrupt global oil production or transit, that will boost oil prices and create a new headwind on markets. Similarly, if these isolated conflicts begin to spread into larger regional conflicts that will also lift oil prices and weigh on stocks and bonds.

- Finally, investors still expect two interest rate cuts from the Federal Reserve between now and year-end; however, the unknown impact from tariffs on economic growth and inflation make rate cuts in 2025 far from certain. If the Fed does not cut rates in the coming months, that will increase concerns about an eventual economic slowdown and that could weigh on markets.

Bottom line, markets have been resilient so far this year, but as we start the second half of 2025 there remain numerous, potentially significant risks to the markets and the economy.

To that point, our team at JMG is committed to helping you effectively navigate this investment environment. We remain focused on both opportunities and risks in the markets, and we thank you for your ongoing confidence and trust.

If you have any questions, please consult your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by JMG Financial Group Ltd. (“JMG”), or any non-investment related content, made reference to directly or indirectly in this writing will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm, nor a certified public accounting firm, and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure Brochure discussing our advisory services and fees is available upon request. If you are a JMG client, please remember to contact JMG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. JMG shall continue to rely on the accuracy of information that you have provided.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment.

Market Segment (index representation) as follows: U.S. Large Cap (S&P Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S Bonds (Bloomberg US Aggregate Bond Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bond (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).