Mid-Year Commentary

INVESTMENT COMMITTEE COMMENTARY June 2022

In June, CPI inflation rose by 1% to 8.5%, its highest level since 1981. Inflation expectations of consumers, measured by the University of Michigan, rose to a 14-year high. The Reuters/University of Michigan Consumer Sentiment Index dropped to its lowest level since 1980. Falling consumer sentiment contributed to plunging market multiples that impacted the equity markets.

Current inflation data caused a strong reaction from the Federal Reserve (Fed) which raised short-term interest rates by 0.75% in June.

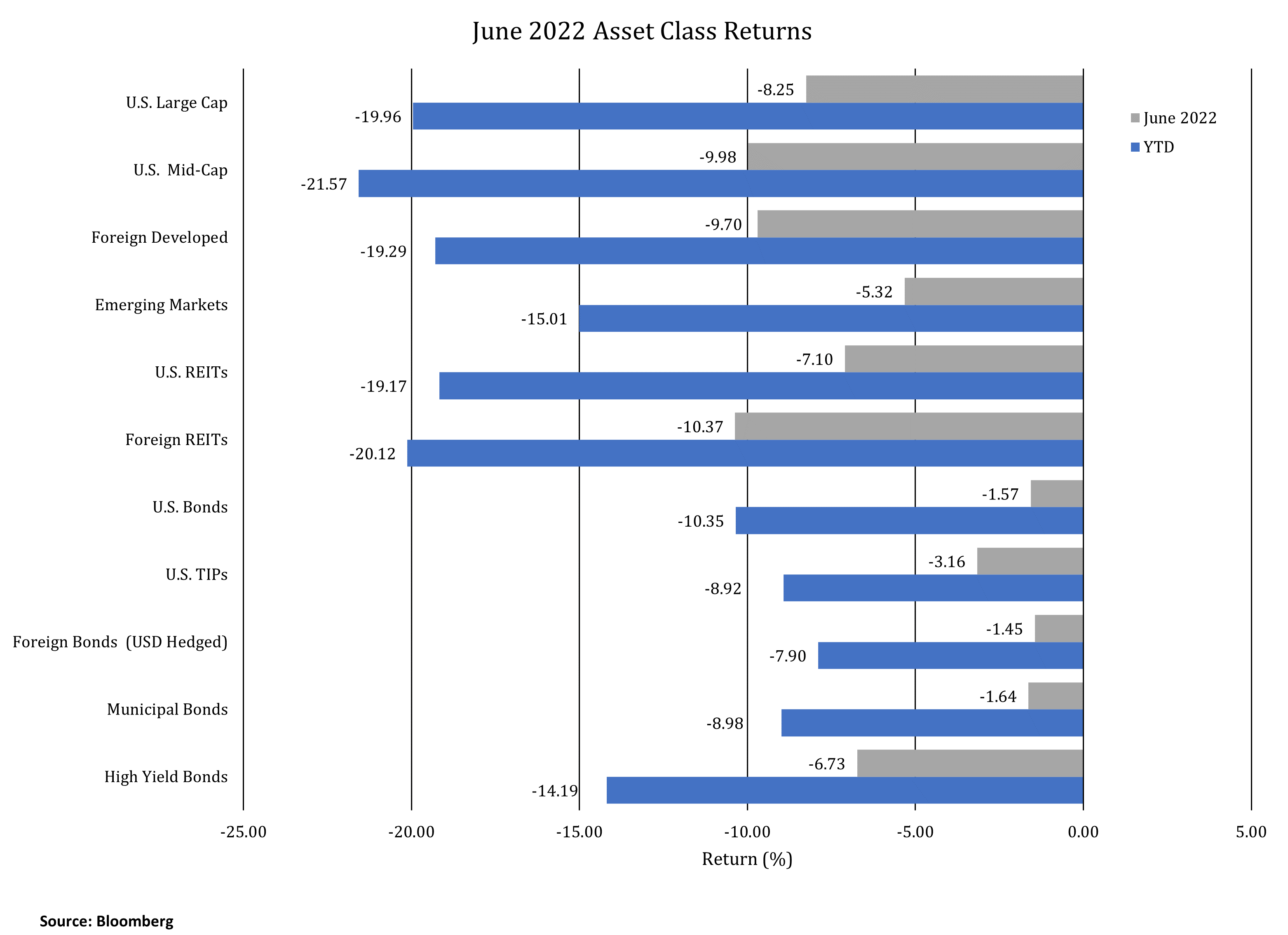

In June, the S&P 500 and foreign developed stocks fell 8.3% and 9.7%, respectively. Emerging market equities declined 5.3%. For the month, the yield on 10-year Treasuries rose from 2.85% to 2.97%, but with a mid-month spike to as high as 3.48% before yields receded. The volatile yields were due to higher than expected inflation and the market’s uncertain reaction to how the Fed would respond. Fed Chair, Jerome Powell, most recently said the Fed will not let the economy slip into a “higher inflation regime” even if it means raising interest rates to higher levels that put economic growth at risk.

It appears the Fed may act more decisively to achieve price stability. With hindsight, the Fed was late to hike interest rates and a faster pace of quantitative tightening can be expected.

Mid-Year Commentary

The poor market performance experienced in the first half of the year, particularly in the second quarter, is rare as noted below. Investor sentiment plunged, largely due to surging inflation, rising interest rates, tightening central bank monetary policies, China’s zero-COVID policies, the Russia-Ukraine war, and concerns of a U.S. recession.

- It was the worst mid-year performance for the S&P 500 since 1970.

- It was the worst mid-year performance for U.S. bonds since data began in 1981.

- It was the worst mid-year performance for a balanced 60/40 stock/bond portfolio since 1932.

- Second quarter S&P 500 performance of -16.5% was the 18th worst quarter since 1929.

Before we examine the various issues driving 2022 market performance, there is potentially positive news for investors waiting for a market turnaround. Historically, the market has rebounded after a bad quarter like the one we just experienced.

- Since World War II, there have been 8 times when the S&P 500 fell more than 15% in a quarter. In the next quarter, 87.5% of the time stocks were up by an average of 6.3%. If the statistics are extended to the next two quarters and beyond, the S&P 500 was up 100% of the time by double-digit returns.

- If inflation moderates sooner than expected, that will be positive for the equity markets as the Fed will be able to intervene at a more moderate level. Since bad news is essentially “baked in” to current valuations, any good news should be positive for returns.

Commentary on Key Economic and Market Issues

Inflation – There are few signs that price pressures are easing. The most recent consumer price index (CPI) increase was 8.5%. Inflation of underlying CPI components illustrates the impact on the U.S consumer: gasoline (48.7%), food at home (11.9%), food away from home (7.4%), truck transportation (25.8%), rent of primary residence (5.2%), owner’s equivalent rent (5.1%), and medical care (3.7%). Cash rents on both existing and new rentals have moved sharply higher as rent moratoriums put in place during the COVID pandemic are expiring. Existing gasoline demand/supply imbalances continue and are compounded by manufacturing issues of summer-grade fuel that requires more crude oil to refine. Gasoline demand is higher in the traditionally peak summer driving season. Wage inflation due to tight labor markets also bears watching.

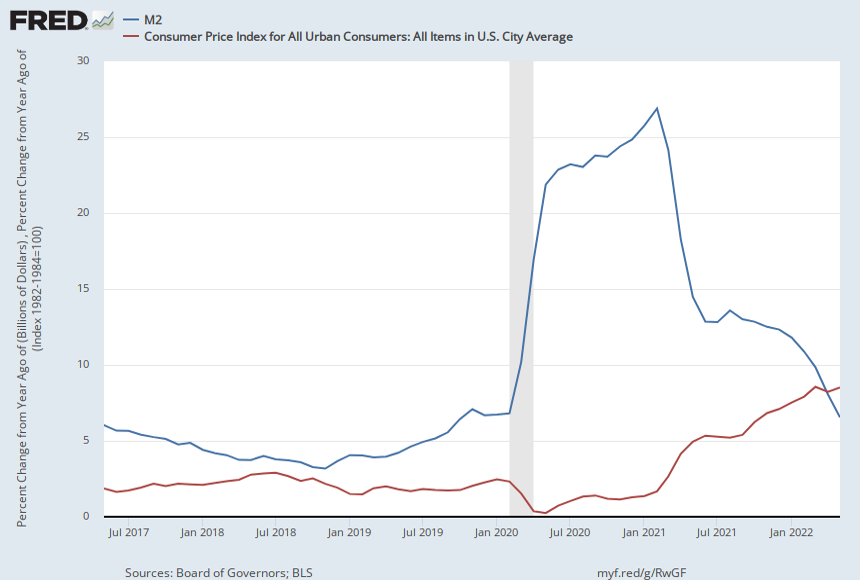

Historically, inflation has had a close relationship to the U.S. Money Supply (M2) as reported by the Fed. The following graph shows the COVID stimulus of 2020 which dramatically increased the year over year money supply (blue line) and fueled the demand for goods. The inflation reaction to the stimulus can be seen by the red line.

Federal Reserve: US Money Supply Growth (M2) vs. CPI

The Federal Reserve said it would do what is needed to get prices under control, reiterating that price stability is necessary to support a strong labor market and calling its commitment to reigning in inflation “unconditional”.

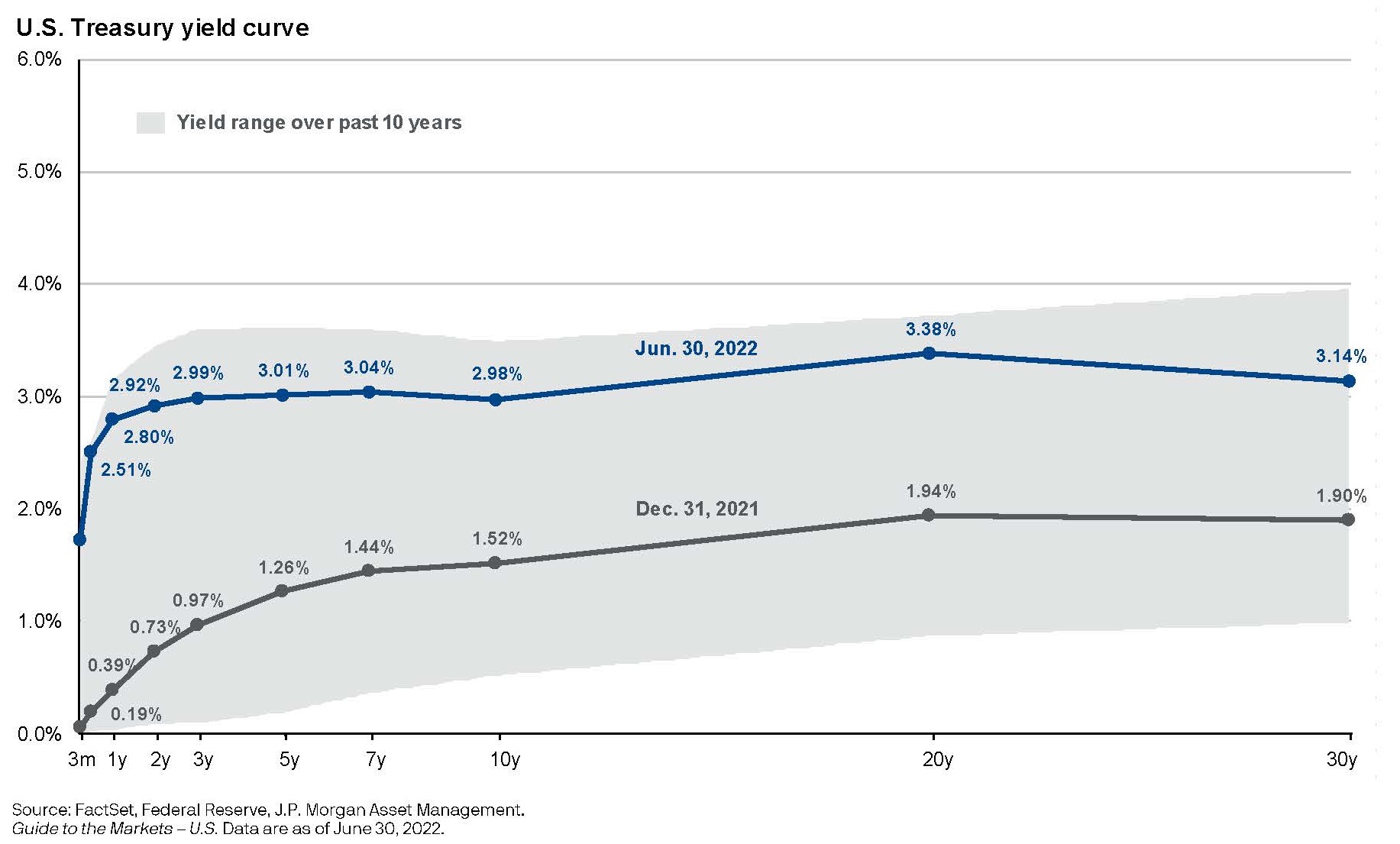

Interest Rates – The period of near zero interest rates is over. Fed Chair Powell has signaled the Fed will continue to raise rates to fight inflation. There is consensus the Fed will continue to raise interest rates until at least early 2023. However, higher interest rate expectations are already reflected in stock and bond prices. Therefore, short of another unforeseen market shock, bond markets can begin to stabilize in the second half of 2022.

While interest rates have risen from unsustainable near zero levels, such higher rates do not lead to positive real returns if inflation remains high. For example, if bond yields rise to 4%, but inflation remains at 9%, the real return is -5%. Over time, inflation will moderate and bonds will eventually earn positive real returns and serve as the equity hedge we expect from them.

The graph below shows the change in U.S. Treasury yields in the first half of 2022. As of June 30th, the yield curve is fairly flat for maturities over 2 years. Such a configuration indicates that recession risks have increased and that investors are rewarded less for owning longer duration bonds. It is impossible to predict interest rates, but the high side expectation for the 10-year Treasury yield is between 3.5% and 3.75%. There is little chance the Fed will cut rates this year.

Bond performance should improve over time. As bonds mature or are sold, reinvestments will be at higher rates. Therefore, drawdowns experienced in 2022 will eventually be offset by higher yields.

Recession – Recession is not a certainty, but the risks of recession have increased. There is more evidence the broad U.S. economy is cooling. For example, the Institute for Supply Management (ISM) Purchasing Managers Index (PMI) surveys over 400 companies for new orders, production, employment, supplier deliveries and inventories. Factory activity growth peaked fifteen months ago and has fallen in six of the last eight months. However, the current level of PMI (53.0 out of 100) is still consistent with the continued expansion in manufacturing output and the broad economy, but at a much slower pace. The U.S. economy is exhibiting late cycle characteristics and the more volatile markets in the first half of 2022 are consistent with a late cycle.

Recession is already priced into the equity markets to some degree as evidenced by a decline in stock market multiples even as S&P 500 earnings are expected to increase. In 2022, S&P 500 earnings have grown by 6.7% but the market multiple has fallen by 27.3%. Multiples have fallen due to extreme negative sentiment of investors caused by interest rates and inflation. Unless the anticipated recession is severe, equity markets can again move to positive performance. Factors pointing toward a shallow recession include elevated corporate profit margins, strong balance sheets and changing COVID policies in China that may ease supply chain issues.

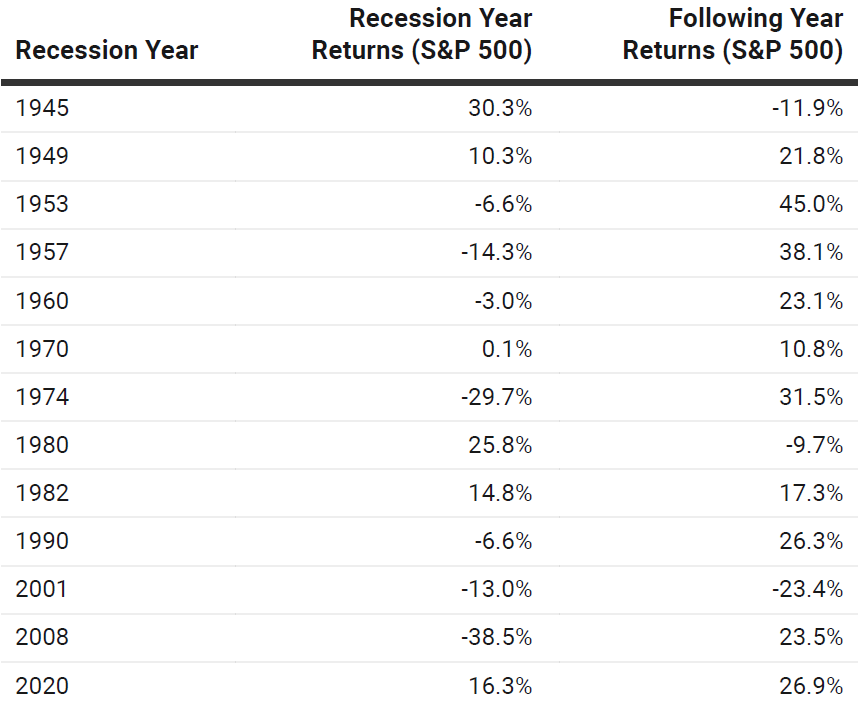

The equity markets typically will look ahead of the current economic conditions and it is impossible for investors to profitably time recessions. Historically, strong stock returns have come on the heels of recessionary periods.

Summary

The first half of 2022 brought a harsh market correction, and there are numerous uncertainties that may hamper positive market progress. Investors should not expect the “V-Recovery” similar to March 2020. The Fed will not step in this time to buoy the markets because of high inflation.

As we move into the second half of 2022, recognizing the immediate economic uncertainties, we continue to recommend neutral allocations to equities. As long-term investors, we prefer equities over fixed income as equities are 20% cheaper than they were at the beginning of the year. For now, fixed income will generate higher absolute returns, but may experience negative real returns until inflation moderates.

In 2022, market valuations have moved lower and nearer to long-term averages. The market has shifted and value stocks have outperformed growth stocks on a relative basis. Valuations are more attractive, particularly for small-cap value stocks. We believe foreign developed and emerging market equities will perform better as Europe reduces its reliance on Russian energy and as China reopens from COVID lockdowns. While the U.S. dollar has risen in value, some expect that the dollar could reverse from its high levels as foreign central banks are also raising interest rates. If the dollar falls, better foreign equity returns can be earned by U.S. investors. Investment opportunities come in volatile markets. Staying invested with discipline will be rewarded.

We continue to closely monitor our client portfolios. If you have any questions, you should consult with your JMG Advisor.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices. Indices are not available for direct investment. Market Segment (index representation) as follows: U.S. Large Cap (S&P 500 Total Return); U.S. Mid-Cap (Russell Midcap Index Total Return); Foreign Developed (FTSE Developed Ex U.S. NR USD); Emerging Markets (FTSE Emerging NR USD); U.S. REITs (FTSE NAREIT Equity Total Return Index); Foreign REITs (FTSE EPRA/NAREIT Developed Real Estate Ex U.S. TR); U.S. Bonds (Bloomberg US Aggregate Index); U.S. TIPs (Bloomberg US Treasury Inflation-Linked Bond Index); Foreign Bonds (USD Hedged) (Bloomberg Global Aggregate Ex US TR Hedged); Municipal Bonds (Bloomberg US Municipal Bond Index); High Yield Bonds (Bloomberg US Corporate High Yield Index).