Monthly Economic News

Monthly Economic News

December 2020 Investment Committee Market Update

INVESTMENT COMMITTEE COMMENTARY DECEMBER 2020

2020 in Review

A year ago, the outlook for 2020 was promising. Global economic conditions were normalizing, consumer sentiment was relatively strong, and inflation was subdued. U.S. unemployment was at a multi-decade low. Internationally, a China trade deal was negotiated, and economic recovery was expected in the United Kingdom with clarified Brexit terms giving economic hope to the Eurozone. No recession was in sight. Investment markets looked past impeachment hearings in January but did anticipate tightly contested U.S. elections.

The coronavirus came suddenly. Global economies substantially closed in February and March as 22 million U.S. persons became unemployed during that period. Stocks plummeted by over 30% as businesses were closed under, now familiar, shelter in place orders.

The Fed was quick to react to the crisis by lowering the federal funds interest rate to near zero. It recognized the need to support U.S. capital markets and made major moves to maintain and support liquidity in the markets. Short-term dislocations did occur as some investors needed to sell securities to reduce leverage and build cash reserves. However, the Fed’s response helped end the stock market’s freefall on March 23rd.

The Fed’s moves were quickly followed by government fiscal actions. The CARES Act became law on March 27th providing $2 trillion in stimulus payments to individuals and businesses impacted by the virus and in need of financial relief. Follow on fiscal stimulus continues, particularly targeting small businesses and service workers.

Stock market recoveries following the initial shock were remarkable. The S&P 500, Russell 2000 and Nasdaq indexes all ended the year at or near all-time highs. Stock market performance was seemingly detached from COVID-19 economic conditions. However, the indexes were propelled by a small number of stocks. Six stocks: Facebook, Apple, Netflix, Microsoft, Amazon, and Alphabet/Google (FANMAG) were able to benefit through the crisis environment. Valuations in these growth stocks are very high and the “valuation gap” with the rest of the index constituents is one of the widest ever. The market valuation gap between new economy stocks and old economy stocks will likely normalize as economies emerge from COVID restrictions later this year.

For the year, the S&P 500 gained 18.4%. Developed international and emerging market stock indexes were also up 8.3% and 18.7%, respectively. U.S. bonds had strong performance as interest rates declined. The total return of the Bloomberg Barclays U.S. Aggregate Bond Index was 7.5%, as 10-year U.S. Treasury yields fell from 1.92% to 0.93%.

Base Case Views for 2021

The following are views impacting our portfolio positioning in 2021.

· Global economic conditions improve as COVID vaccines take effect

· Equities benefit from COVID recovery, additional fiscal stimulus and improved corporate earnings

· Equities benefit with most central banks continuing accommodative policies

· Federal Reserve holds short-term interest rates near zero, but nominal yields do not go negative

· With Treasury bond yields low, demand for incremental yield (credit / high yield) should increase

· Foreign equities benefit from lower valuations and continuing downtrend of the U.S. dollar

· Equity valuations normalize and FANMAG stocks may lag based on high relative valuations

· U.S. unemployment more likely takes longer to recover

· Inflation stays subdued but CPI has the potential to climb over 2%

Commentary on Base Case Views

Equities

We see the global economy in early cycle recovery leading to a tailwind for equities. However, not all industries will recover at the same pace as some will be structurally changed after COVID. As noted above, the FANMAG stocks have performed very well as these companies were well positioned to survive and thrive through the economic disruptions. JP Morgan recently analyzed the valuations of the top ten stocks of the S&P 500 compared to the remaining 490 stocks. The forward price/earnings ratio of the top 10 was 33.3 times vs. 19.7 times for the other 490 stocks. In 2020, the weight of the top 10 stocks in the S&P 500 reached an all-time high with a weighting of 28.6% at year-end.

Historically, we have seen other periods of index concentration and disparate valuations. In the 1960s, the “Nifty-Fifty” were characterized by high valuations and “justified” by consistent earnings. In the dotcom bubble of 2000, growth stock valuations soared to levels even higher than today. Eventually, reality brings prices and valuations together again to reasonable levels.

Because global economies are expected to begin normalization in 2021, we are cautiously optimistic for continued good equity performance this year. Investors may rotate to the sectors and industries which underperformed in 2020 but are positioned to rebound in a post-pandemic economy. Equity leadership may very well come from the “S&P 490” this year.

Headwinds to continued strong equity performance include potentially lower earnings growth and higher inflation. While prospects are better, the U.S. economy has not yet emerged from the COVID pandemic. Vaccine distribution is behind schedule in the U.S. If economic recovery is delayed, the market rebound of 2020 may be ahead of itself. The Federal Reserve may have limited ability to implement additional monetary stimulus. Watch for fiscal stimulus such as infrastructure projects from the incoming Biden Administration.

Finally, considering the relative attractiveness of equities to fixed income investments going forward, a strong case can be made for equities. Low interest rate policies of central banks are making equity investments more attractive. The earnings yield on the S&P 500 was 4.5% as of year-end, a spread of about 3% above CPI inflation. Fixed income yields are very low and expected to continue for several years. Equities, while carrying higher risk, may offer a better chance for long-term positive real returns.

Fixed Income

Fixed income performed well in 2020 because interest rates fell during the year. The 10-year Treasury yield fell by 0.99% and TIPS yields fell by 1.21%. Significantly further declines in yields are unlikely. Therefore, fixed income returns in 2021 are expected to be less than the returns of 2020 unless U.S. interest rates decline further.

If interest rates remain stable, forward-looking fixed income returns would more likely be around current yield levels. For example, the expected return on ten-year Treasuries would be about 1%. Here lies the dilemma. Government bonds have traditionally been the portfolio ballast to provide support through equity market declines. The benefit of bonds in a portfolio was demonstrated by strong bond returns during the market shocks of 2020.

Assuming the U.S. is in early cycle recovery as economies emerge from COVID lockdowns, certain segments of the credit markets may provide opportunities. For example, high-quality corporate investment grade issuers and housing-related credits that were disrupted in 2020 could earn higher returns. Active fixed income managers, including those recommended by JMG, are positioned to add value as these opportunities are identified.

Fixed income investors should expect muted returns going forward. That said, JMG continues to recommend allocations to fixed income as a hedge against equity risk or in the event of another external “risk-off” market shock. Essentially, fixed income is acting as portfolio insurance with the “cost” of the insurance being reflected by lower yields. We continue to evaluate other fixed income alternatives that may add value, but these strategies carry different risks and may not hedge an equity decline when needed. Credit risk requires careful analysis.

Observations

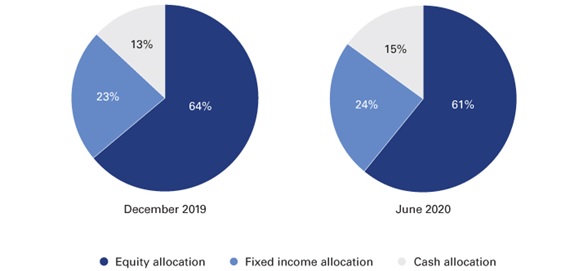

If we learned anything in 2020, investment discipline carried investors successfully through the chaotic and uncertain markets of the year. The Vanguard Group, Inc. analyzed pre-pandemic and post-pandemic trading behaviors of affluent investors in 2020. Vanguard found that while trading activity increased during the equity decline and in the volatile months of the pandemic, affluent investor asset allocations remained substantially the same. This served investors well as no one could have predicted that equities would have recovered to record levels by the end of 2020.

Regarding asset allocations, we are recommending investors tend toward neutral / strategic asset allocation weightings. This includes foreign developed and emerging market country equities which have attractive valuations relative to U.S growth companies and where U.S. investors could benefit if the U.S. dollar trends lower.

2020 was a challenging but ultimately rewarding year for investors. Please contact your JMG advisor with questions or concerns.

Important Disclosure

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this writing, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this writing serves as the receipt of, or as a substitute for, personalized investment advice from JMG Financial Group, Ltd. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. JMG is neither a law firm nor a certified public accounting firm and no portion of the content provided in this writing should be construed as legal or accounting advice. A copy of JMG’s current written disclosure statement discussing advisory services and fees is available for review upon request.

To the extent provided in this writing, historical performance results for investment indices and/or categories have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices.